Question: please exolain how to get the correct answer C Use the information for the question(s) below. Consider two firms, Firm X and Firm Y, that

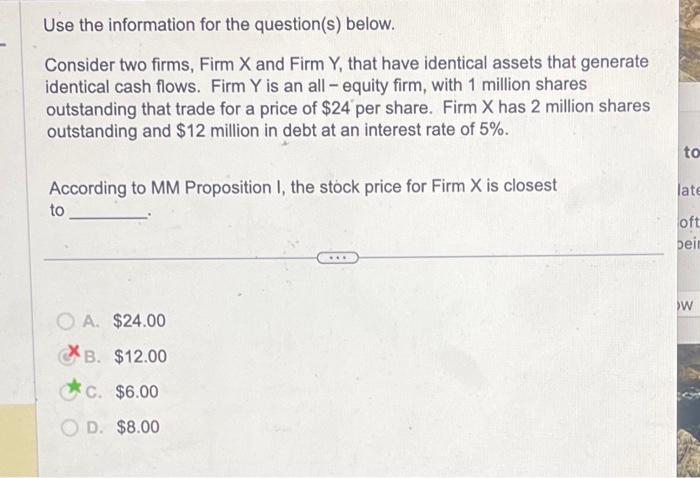

Use the information for the question(s) below. Consider two firms, Firm X and Firm Y, that have identical assets that generate identical cash flows. Firm Y is an all - equity firm, with 1 million shares outstanding that trade for a price of $24 per share. Firm X has 2 million shares outstanding and $12 million in debt at an interest rate of 5%. According to MM Proposition I, the stock price for Firm X is closest to A. $24.00 B. $12.00 C. $6.00 D. $8.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts