Question: Please explain all steps and provide the formulas used to answer these questions. Please fill out the chart as well. #13 Recovery Centers of America

Please explain all steps and provide the formulas used to answer these questions. Please fill out the chart as well.

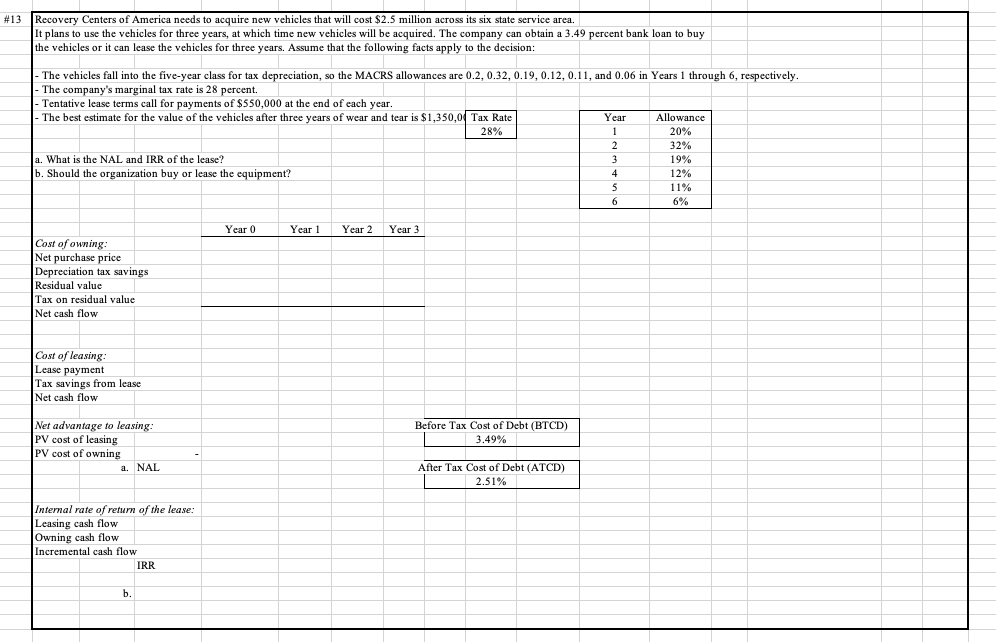

#13 Recovery Centers of America needs to acquire new vehicles that will cost $2.5 million across its six state service area. It plans to use the vehicles for three years, at which time new vehicles will be acquired. The company can obtain a 3.49 percent bank loan to buy the vehicles or it can lease the vehicles for three years. Assume that the following facts apply to the decision: - The vehicles fall into the five-year class for tax depreciation, so the MACRS allowances are 0.2,0.32,0.19,0.12,0.11, and 0.06 in Years 1 through 6 , respectively. - The company's marginal tax rate is 28 percent. - Tentative lease terms call for payments of $550,000 at the end of each year. - The best estimate for the value of the vehicles after three years of wear and tear is $1,350,0 a. What is the NAL and IRR of the lease? b. Should the organization buy or lease the equipment? \begin{tabular}{|c|c|} \hline Year & Allowance \\ \hline 1 & 20% \\ \hline 2 & 32% \\ \hline 3 & 19% \\ \hline 4 & 12% \\ \hline 5 & 11% \\ \hline 6 & 6% \\ \hline \end{tabular} Cost of owning: \begin{tabular}{|l|l|l|l|l|l|l|l|l|} \hline Year 0 & Year 1 & Year 2 & Year 3 \\ \hline & & & & & \\ \hline \end{tabular} Internal rate of return of the lease: Leasing cash flow Owning cash flow Incremental cash flow IRR b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts