Question: Please explain all steps and provide the formulas used to answer these questions. Please state what numbers will be used in the formula as well.

Please explain all steps and provide the formulas used to answer these questions. Please state what numbers will be used in the formula as well. Please fill out the chart as well.

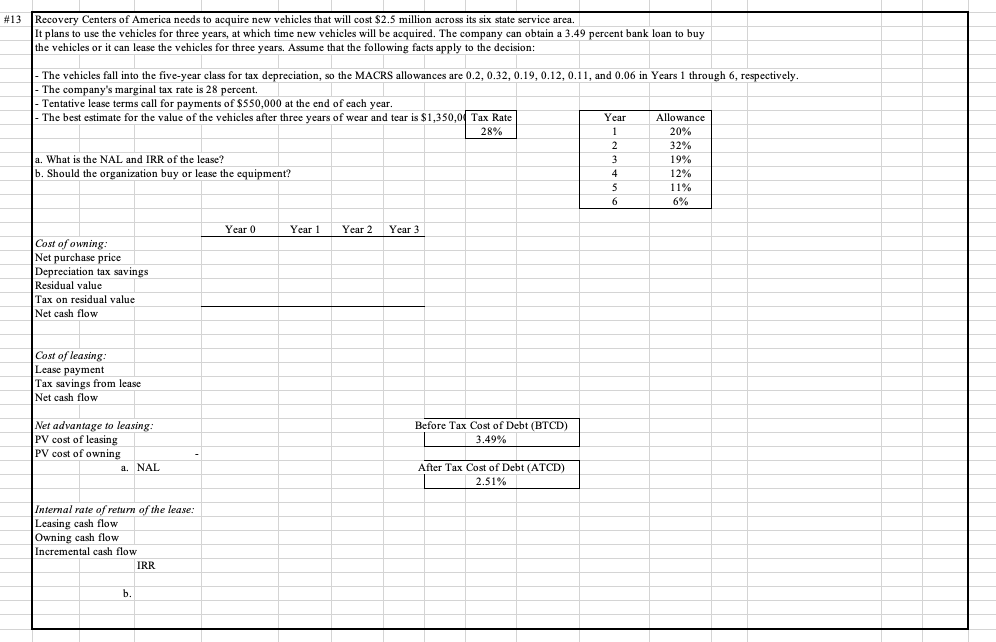

#13 Recovery Centers of America needs to acquire new vehicles that will cost $2.5 million across its six state service area. It plans to use the vehicles for three years, at which time new vehicles will be acquired. The company can obtain a 3.49 percent bank loan to buy the vehicles or it can lease the vehicles for three years. Assume that the following facts apply to the decision: - The vehicles fall into the five-year class for tax depreciation, so the MACRS allowances are 0.2,0.32,0.19,0.12,0.11, and 0.06 in Years 1 through 6 , respectively. - The company's marginal tax rate is 28 percent. - Tentative lease terms call for payments of $550,000 at the end of each year. - The best estimate for the value of the vehicles after three years of wear and tear is $1,350,0 a. What is the NAL and IRR of the lease? b. Should the organization buy or lease the equipment? \begin{tabular}{|c|c|} \hline Year & Allowance \\ \hline 1 & 20% \\ \hline 2 & 32% \\ \hline 3 & 19% \\ \hline 4 & 12% \\ \hline 5 & 11% \\ \hline 6 & 6% \\ \hline \end{tabular} Cost of owning: \begin{tabular}{|l|l|l|l|l|l|l|l|l|} \hline Year 0 & Year 1 & Year 2 & Year 3 \\ \hline & & & & & \\ \hline \end{tabular} Internal rate of return of the lease: Leasing cash flow Owning cash flow Incremental cash flow IRR b. #13 Recovery Centers of America needs to acquire new vehicles that will cost $2.5 million across its six state service area. It plans to use the vehicles for three years, at which time new vehicles will be acquired. The company can obtain a 3.49 percent bank loan to buy the vehicles or it can lease the vehicles for three years. Assume that the following facts apply to the decision: - The vehicles fall into the five-year class for tax depreciation, so the MACRS allowances are 0.2,0.32,0.19,0.12,0.11, and 0.06 in Years 1 through 6 , respectively. - The company's marginal tax rate is 28 percent. - Tentative lease terms call for payments of $550,000 at the end of each year. - The best estimate for the value of the vehicles after three years of wear and tear is $1,350,0 a. What is the NAL and IRR of the lease? b. Should the organization buy or lease the equipment? \begin{tabular}{|c|c|} \hline Year & Allowance \\ \hline 1 & 20% \\ \hline 2 & 32% \\ \hline 3 & 19% \\ \hline 4 & 12% \\ \hline 5 & 11% \\ \hline 6 & 6% \\ \hline \end{tabular} Cost of owning: \begin{tabular}{|l|l|l|l|l|l|l|l|l|} \hline Year 0 & Year 1 & Year 2 & Year 3 \\ \hline & & & & & \\ \hline \end{tabular} Internal rate of return of the lease: Leasing cash flow Owning cash flow Incremental cash flow IRR b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts