Question: Please Explain all steps Computing Pension Expense, Gain/Loss Amortization, PBO, and Plan Asset Balances The following data relate to a defined benefit pension plan for

Please Explain all steps

Please Explain all steps

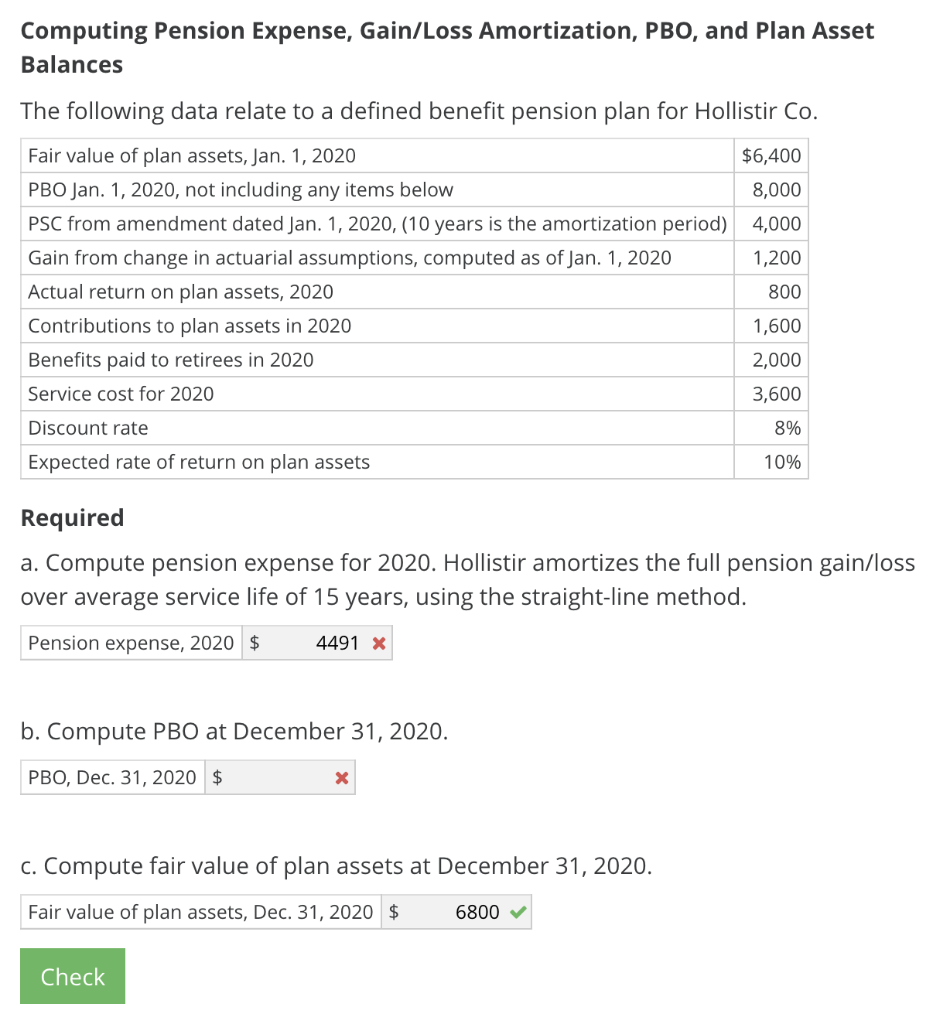

Computing Pension Expense, Gain/Loss Amortization, PBO, and Plan Asset Balances The following data relate to a defined benefit pension plan for Hollistir Co. Fair value of plan assets, Jan. 1, 2020 $6,400 PBO Jan. 1, 2020, not including any items below 8,000 PSC from amendment dated Jan. 1, 2020, (10 years is the amortization period) 4,000 Gain from change in actuarial assumptions, computed as of Jan. 1, 2020 1,200 Actual return on plan assets, 2020 800 Contributions to plan assets in 2020 1,600 Benefits paid to retirees in 2020 2,000 Service cost for 2020 3,600 Discount rate 8% Expected rate of return on plan assets 10% Required a. Compute pension expense for 2020. Hollistir amortizes the full pension gain/loss over average service life of 15 years, using the straight-line method. Pension expense, 2020 $ 4491 X b. Compute PBO at December 31, 2020. PBO, Dec. 31, 2020 $ X c. Compute fair value of plan assets at December 31, 2020. Fair value of plan assets, Dec. 31, 2020 $ 6800 Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts