Question: SLE Ventures is making an $8M Series A investment in MemChu TechCo. The founders and employees of MemChu (together called the founders) have claims

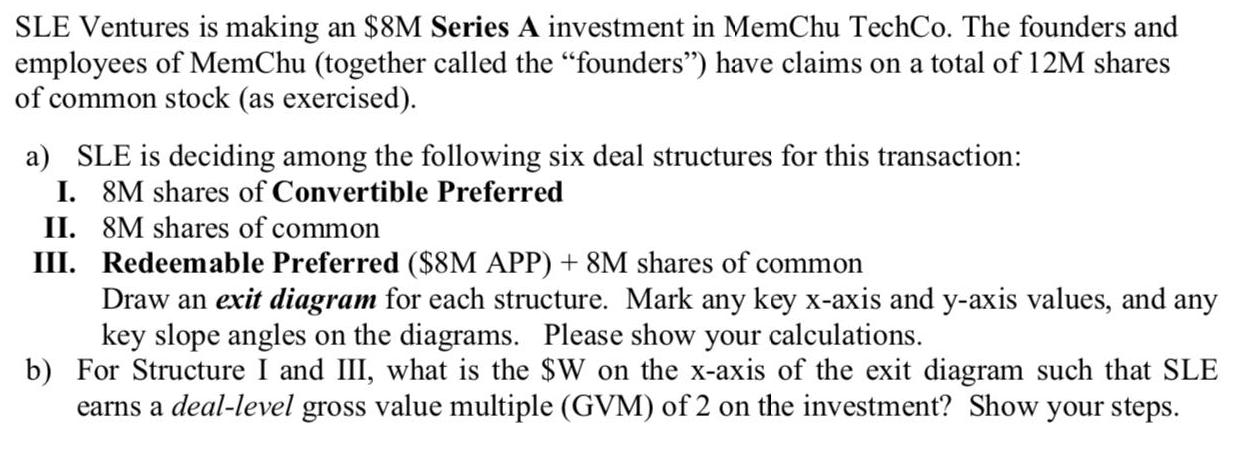

SLE Ventures is making an $8M Series A investment in MemChu TechCo. The founders and employees of MemChu (together called the "founders") have claims on a total of 12M shares of common stock (as exercised). a) SLE is deciding among the following six deal structures for this transaction: I. 8M shares of Convertible Preferred II. 8M shares of common III. Redeemable Preferred ($8M APP) + 8M shares of common Draw an exit diagram for each structure. Mark any key x-axis and y-axis values, and any key slope angles on the diagrams. Please show your calculations. b) For Structure I and III, what is the $W on the x-axis of the exit diagram such that SLE earns a deal-level gross value multiple (GVM) of 2 on the investment? Show your steps.

Step by Step Solution

3.56 Rating (187 Votes )

There are 3 Steps involved in it

To tackle this question we need to analyze the exit diagrams for the given deal structures and calculate the required conditions for a deallevel gross ... View full answer

Get step-by-step solutions from verified subject matter experts