Question: Please explain and show work for #5-#7. Thanks AI Tool and Dye issued 8% bonds with a face amount of $160 million on January 1,

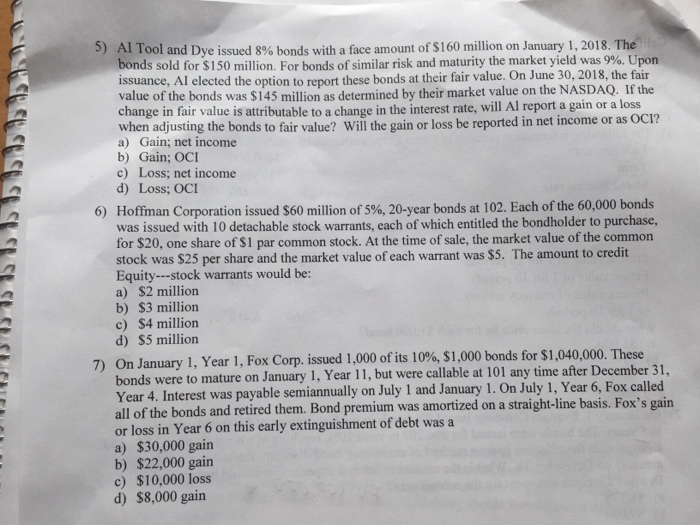

AI Tool and Dye issued 8% bonds with a face amount of $160 million on January 1, 2018 The bonds sold for $150 million. For bonds of similar risk and maturity the market yield was 9%, Upon issuance, Al elected the option to report these bonds at their fair value. On June 30, 2018, the fair value of the bonds was $145 million as determined by their market value on the NASDAQ. If the change in fair value is attributable to a change in the interest rate, will Al report a gain or a loss when adjusting the bonds to fair value? Will the gain or loss be reported in net income or as OCI? a) Gain; net income b) Gain; OCI c) Loss; net income d) Loss; OCI 5) Hoffman Corporation issued $60 million of 5%, 20-year bonds at 102. Each of the 60,000 bonds was issued with 10 detachable stock warrants, each of which entitled the bondholder to purchase, for $20, one share of $1 par common stock. At the time of sale, the market value of the common stock was $25 per share and the market value of each warrant was $5. The amount to credit Equitystock warrants would be: a) $2 million b) $3 million c) $4 million d) S5 million 6) 7) On January 1, Year 1, Fox Corp. iss bonds were to mature on January 1, Year 11, but were callable at 101 any time after December 31, Year 4. Interest was payable semiannually on July 1 and January 1. On July 1, Year 6, Fox called all of the bonds and retired them. Bond premium was amortized on a straight-line basis. Fox's gain or loss in Year 6 on this early extinguishment of debt was a a) $30,000 gain b) $22,000 gain c) $10,000 loss d) $8,000 gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts