Question: please explain and solve for 12&13 12. The annual return on the S&P 500 Index was 13.4 percent. The annual T-bill yield during the same

please explain and solve for 12&13

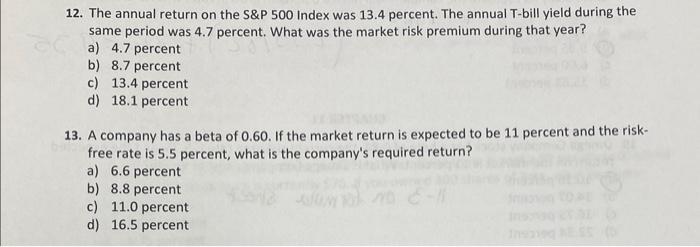

12. The annual return on the S\&P 500 Index was 13.4 percent. The annual T-bill yield during the same period was 4.7 percent. What was the market risk premium during that year? a) 4.7 percent b) 8.7 percent c) 13.4 percent d) 18.1 percent 13. A company has a beta of 0.60. If the market return is expected to be 11 percent and the riskfree rate is 5.5 percent, what is the company's required return? a) 6.6 percent b) 8.8 percent c) 11.0 percent d) 16.5 percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock