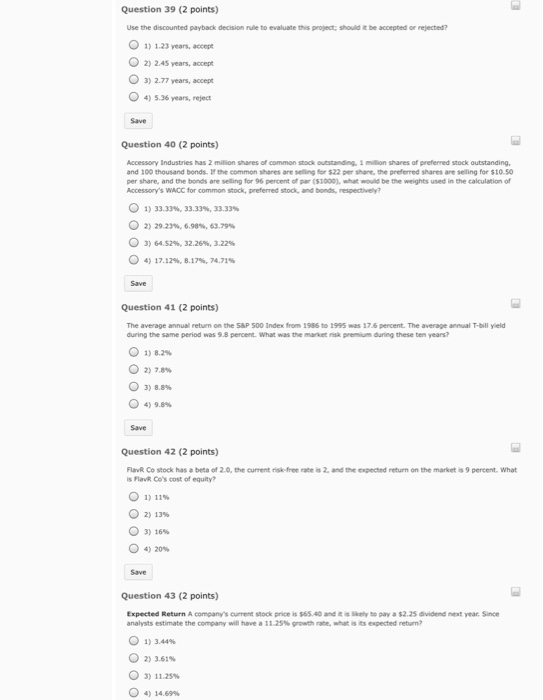

Question: Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected? 1.23 rears, accept 2.45 years, accept 2.77 years, accept

Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected? 1.23 rears, accept 2.45 years, accept 2.77 years, accept 5.36 years, reject Accessory Industries has 2 million shares of common stock outstanding, 1 million shares of preferred stock outstanding, and 100 thousand bonds. If the common shares are selling for $22 per share, the preferred shares are selling for $10.50 per share, and the bonds are selling for to percent of par ($1000), what would be the weights used in the calculation of Accessory's WACC for common stock, preferred stock, and bonds, respectively? 33.33%, 33.33%, 33.33% 29.23%, 6.98%, 63.79% 64.52%, 32.26%, 3.22% 17.12%, 8.17%, 74.71% The average annual return on the S&P 500 Index from 1986 to 1995 was 17.6 percent. The average annual T-bill yield during the same period was 9.8 percent. What was the market risk premium during these ten years? 8.2% 7.8% 8.8% 9.8% FlavR Co stock has a beta of 2.0, the current risk-free rate is 2, and the expected return on the market is 9 percent. What is FlavR Co's cost of equity? 11% 13% 16% 20% A company's current stock price is $65.40 and it is likely to pay a $2.25 dividend next year. since analysis estimate the company will have a 11.25% growth rate, what is its expected return? 3.44% 3.61% 11.25% 14.69% Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected? 1.23 rears, accept 2.45 years, accept 2.77 years, accept 5.36 years, reject Accessory Industries has 2 million shares of common stock outstanding, 1 million shares of preferred stock outstanding, and 100 thousand bonds. If the common shares are selling for $22 per share, the preferred shares are selling for $10.50 per share, and the bonds are selling for to percent of par ($1000), what would be the weights used in the calculation of Accessory's WACC for common stock, preferred stock, and bonds, respectively? 33.33%, 33.33%, 33.33% 29.23%, 6.98%, 63.79% 64.52%, 32.26%, 3.22% 17.12%, 8.17%, 74.71% The average annual return on the S&P 500 Index from 1986 to 1995 was 17.6 percent. The average annual T-bill yield during the same period was 9.8 percent. What was the market risk premium during these ten years? 8.2% 7.8% 8.8% 9.8% FlavR Co stock has a beta of 2.0, the current risk-free rate is 2, and the expected return on the market is 9 percent. What is FlavR Co's cost of equity? 11% 13% 16% 20% A company's current stock price is $65.40 and it is likely to pay a $2.25 dividend next year. since analysis estimate the company will have a 11.25% growth rate, what is its expected return? 3.44% 3.61% 11.25% 14.69%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts