Question: Please Explain and solve using Algebra not Excel.Thank you 1. Use Yahoo Finance to look at stock prices, look for GOOG(Google), follow the link for

Please Explain and solve using Algebra not Excel.Thank you

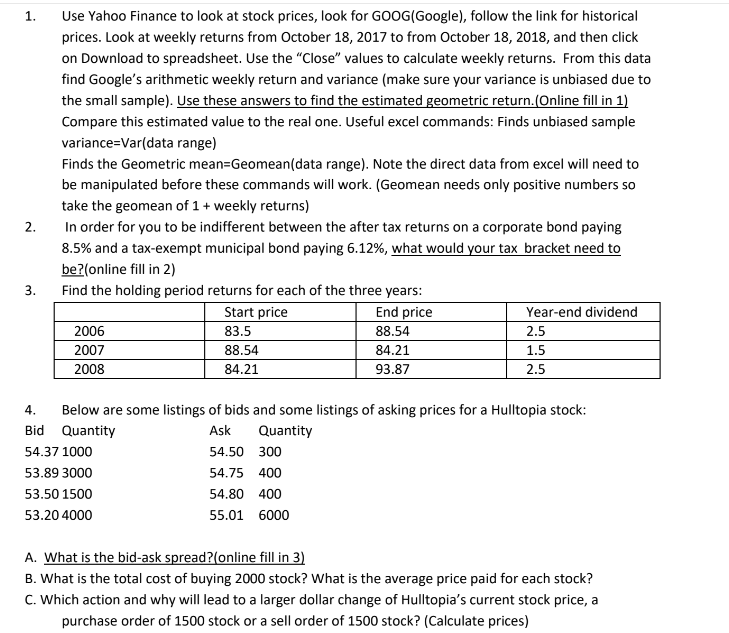

1. Use Yahoo Finance to look at stock prices, look for GOOG(Google), follow the link for historical prices. Look at weekly returns from October 18, 2017 to from October 18, 2018, and then click on Download to spreadsheet. Use the "Close" values to calculate weekly returns. From this data find Google's arithmetic weekly return and variance (make sure your variance is unbiased due to the small sample). Use these answers to find the estimated geometric return.(Online fill in 1) Compare this estimated value to the real one. Useful excel commands: Finds unbiased sample variance-Var(data range) Finds the Geometric mean-Geomean(data range). Note the direct data from excel will need to be manipulated before these commands will work. (Geomean needs only positive numbers so take the geomean of 1weekly returns) In order for you to be indifferent between the after tax returns on a corporate bond paying 8.5% and a tax-exempt municipal bond paying 6.12%, what would your tax bracket need to be?(online fl in 2) 2. 3. Find the holding period returns for each of the three years 2006 2007 2008 Start price 83.5 88.54 84.21 End price 88.54 84.21 93.87 Year-end dividend 2.5 1.5 2.5 4. Below are some listings of bids and some listings of asking prices for a Hulltopia stock: Bid Quantity 54.37 1000 53.89 3000 53.50 1500 53.204000 Ask Quantity 54.50 300 54.75 400 54.80 400 55.01 6000 A. What is the bid-ask spread?(online fill in 3 B. what is the total cost of buying 2000 stock? what is the average price paid for each stock? C. Which action and why will lead to a larger dollar change of Hultopia's current stock price, a purchase order of 1500 stock or a sell order of 1500 stock? (Calculate prices) 1. Use Yahoo Finance to look at stock prices, look for GOOG(Google), follow the link for historical prices. Look at weekly returns from October 18, 2017 to from October 18, 2018, and then click on Download to spreadsheet. Use the "Close" values to calculate weekly returns. From this data find Google's arithmetic weekly return and variance (make sure your variance is unbiased due to the small sample). Use these answers to find the estimated geometric return.(Online fill in 1) Compare this estimated value to the real one. Useful excel commands: Finds unbiased sample variance-Var(data range) Finds the Geometric mean-Geomean(data range). Note the direct data from excel will need to be manipulated before these commands will work. (Geomean needs only positive numbers so take the geomean of 1weekly returns) In order for you to be indifferent between the after tax returns on a corporate bond paying 8.5% and a tax-exempt municipal bond paying 6.12%, what would your tax bracket need to be?(online fl in 2) 2. 3. Find the holding period returns for each of the three years 2006 2007 2008 Start price 83.5 88.54 84.21 End price 88.54 84.21 93.87 Year-end dividend 2.5 1.5 2.5 4. Below are some listings of bids and some listings of asking prices for a Hulltopia stock: Bid Quantity 54.37 1000 53.89 3000 53.50 1500 53.204000 Ask Quantity 54.50 300 54.75 400 54.80 400 55.01 6000 A. What is the bid-ask spread?(online fill in 3 B. what is the total cost of buying 2000 stock? what is the average price paid for each stock? C. Which action and why will lead to a larger dollar change of Hultopia's current stock price, a purchase order of 1500 stock or a sell order of 1500 stock? (Calculate prices)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts