Question: Please explain answer and reshow how it is done, as I am confused by how it is done here. On Monday, November 16, you assume

Please explain answer and reshow how it is done, as I am confused by how it is done here.

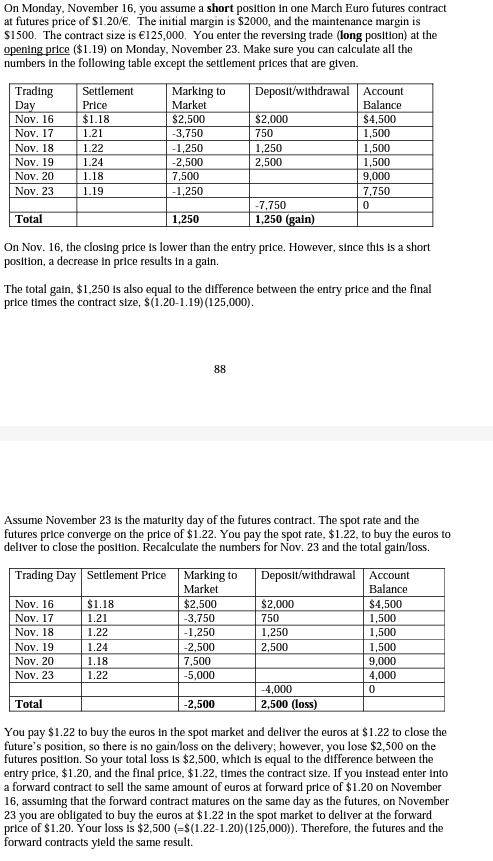

On Monday, November 16, you assume a short position in one March Euro futures contract at futures price of $1.20/. The initial margin is $2000, and the maintenance margin is $1500. The contract size is 125,000. You enter the reversing trade (long position) at the opening price (\$1.19) on Monday, November 23. Make sure you can calculate all the numbers in the following table except the settlement prices that are given. On Nov. 16, the closing price is lower than the entry price. However, since this is a short position, a decrease in price results in a gain. The total gain, $1,250 is also equal to the difference between the entry price and the final price times the contract size, $(1.201.19)(125,000). 88 Assume November 23 is the maturity day of the futures contract. The spot rate and the futures price converge on the price of $1.22. You pay the spot rate, $1.22, to buy the euros to deliver to close the position. Recalculate the numbers for Nov. 23 and the total gain/loss. You pay $1.22 to buy the euros in the spot market and deliver the euros at $1.22 to close the future's position, so there is no gain/loss on the delivery; however, you lose $2,500 on the futures position. So your total loss is $2,500, which is equal to the difference between the entry price, $1.20, and the final price, $1.22, times the contract size. If you instead enter into a forward contract to sell the same amount of euros at forward price of $1.20 on November 16, assuming that the forward contract matures on the same day as the futures, on November 23 you are obligated to buy the euros at $1.22 in the spot market to deliver at the forward price of $1.20. Your loss is $2,500(=$(1.221.20)(125,000)). Therefore, the futures and the forward contracts yield the same result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts