Question: Please explain answer and reshow how it is done, as I am confused by how it is done here. Suppose that on Monday, 16 November,

Please explain answer and reshow how it is done, as I am confused by how it is done here.

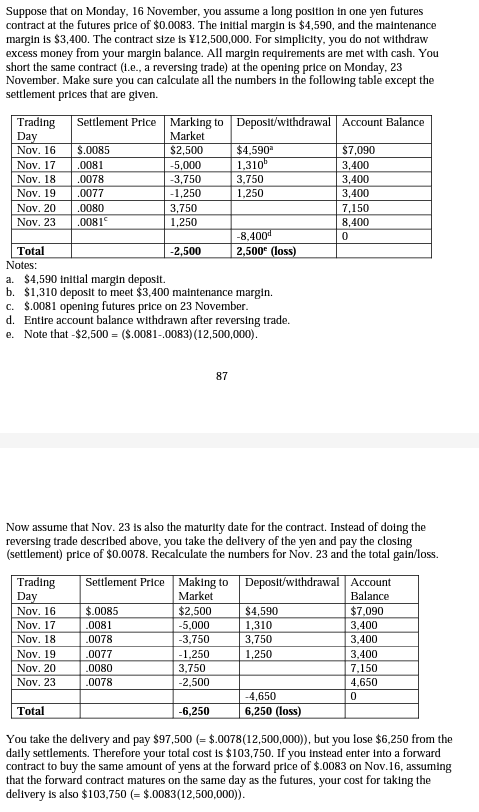

Suppose that on Monday, 16 November, you assume a long position in one yen futures contract at the futures price of $0.0083. The initial margin is $4,590, and the maintenance margin is $3,400. The contract size is 12,500,000. For simplicity, you do not withdraw excess money from your margin balance. All margin requirements are met with cash. You short the same contract (i.e., a reversing trade) at the opening price on Monday, 23 November. Make sure you can calculate all the numbers in the following table except the settlement prices that are given. Ivotes: a. $4,590 initial margin deposit. b. $1,310 deposit to meet $3,400 maintenance margin. c. $.0081 opening futures price on 23 November. d. Entire account balance withdrawn after reversing trade. e. Note that $2,500=($.0081.0083)(12,500,000). 87 Now assume that Nov. 23 is also the maturity date for the contract. Instead of doing the reversing trade described above, you take the delivery of the yen and pay the closing (settlement) price of $0.0078. Recalculate the numbers for Nov. 23 and the total gain/loss. You take the delivery and pay $97,500 (= $.0078(12,500,000) ), but you lose $6,250 from the daily settlements. Therefore your total cost is $103,750. If you instead enter into a forward contract to buy the same amount of yens at the forward price of $.0083 on Nov.16, assuming that the forward contract matures on the same day as the futures, your cost for taking the delivery is also $103,750(=$.0083(12,500,000)). Suppose that on Monday, 16 November, you assume a long position in one yen futures contract at the futures price of $0.0083. The initial margin is $4,590, and the maintenance margin is $3,400. The contract size is 12,500,000. For simplicity, you do not withdraw excess money from your margin balance. All margin requirements are met with cash. You short the same contract (i.e., a reversing trade) at the opening price on Monday, 23 November. Make sure you can calculate all the numbers in the following table except the settlement prices that are given. Ivotes: a. $4,590 initial margin deposit. b. $1,310 deposit to meet $3,400 maintenance margin. c. $.0081 opening futures price on 23 November. d. Entire account balance withdrawn after reversing trade. e. Note that $2,500=($.0081.0083)(12,500,000). 87 Now assume that Nov. 23 is also the maturity date for the contract. Instead of doing the reversing trade described above, you take the delivery of the yen and pay the closing (settlement) price of $0.0078. Recalculate the numbers for Nov. 23 and the total gain/loss. You take the delivery and pay $97,500 (= $.0078(12,500,000) ), but you lose $6,250 from the daily settlements. Therefore your total cost is $103,750. If you instead enter into a forward contract to buy the same amount of yens at the forward price of $.0083 on Nov.16, assuming that the forward contract matures on the same day as the futures, your cost for taking the delivery is also $103,750(=$.0083(12,500,000))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts