Question: please explain calculations so i can understand. thanks! Exercise 4-16A Effect of sales returns and allowances and freight costs on the journal, ledger, and financial

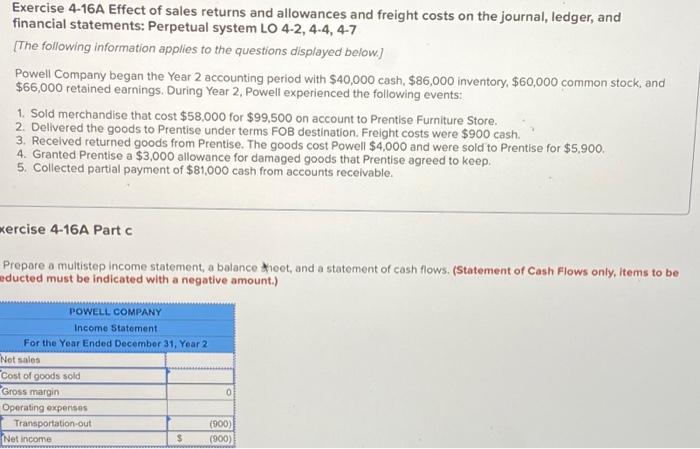

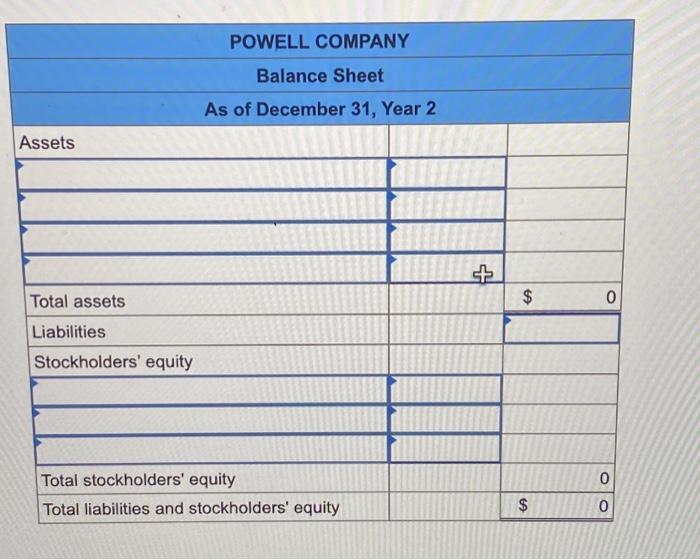

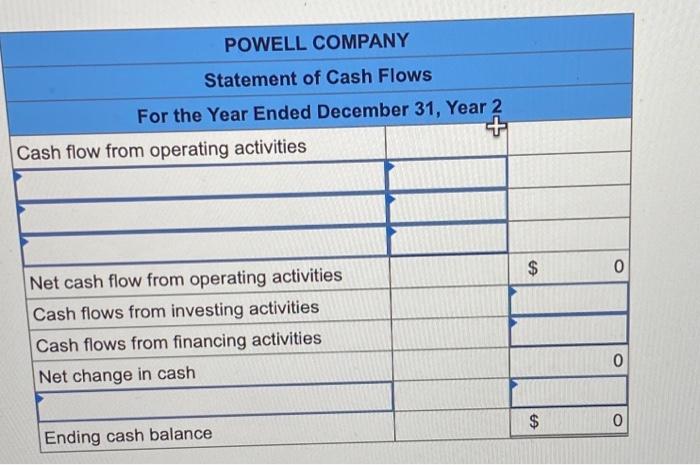

Exercise 4-16A Effect of sales returns and allowances and freight costs on the journal, ledger, and financial statements: Perpetual system LO 4-2,4-4, 4-7 (The following information applies to the questions displayed below.) Powell Company began the Year 2 accounting period with $40,000 cash, $86,000 inventory $60,000 common stock, and $66,000 retained earnings. During Year 2, Powell experienced the following events: 1. Sold merchandise that cost $58,000 for $99,500 on account to Prentise Furniture Store. 2. Delivered the goods to Prentise under terms FOB destination. Freight costs were $900 cash. 3. Received returned goods from Prentise. The goods cost Powell $4,000 and were sold to Prentise for $5,900. 4. Granted Prentise a $3,000 allowance for damaged goods that Prentise agreed to keep 5. Collected partial payment of $81,000 cash from accounts receivable. xercise 4-16A Part Prepare a multistep income statement, a balance sheet, and a statement of cash flows. (Statement of Cash Flows only, items to be educted must be indicated with a negative amount.) POWELL COMPANY Income Statement For the Year Ended December 31, Year 2 Net sales Cost of goods sold Gross margin 0 Operating expenses Transportation-out (900) Not income (900) POWELL COMPANY Balance Sheet As of December 31, Year 2 Assets $ 0 Total assets Liabilities Stockholders' equity 0 Total stockholders' equity Total liabilities and stockholders' equity $ 0 POWELL COMPANY Statement of Cash Flows For the Year Ended December 31, Year 2 + Cash flow from operating activities $ 0 Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash 0 $ 0 Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts