Question: Please explain. Case 3 In this question, the stock does not pay dividends. The prices of two American puts P1 and P2 with strikes Ki

Please explain.

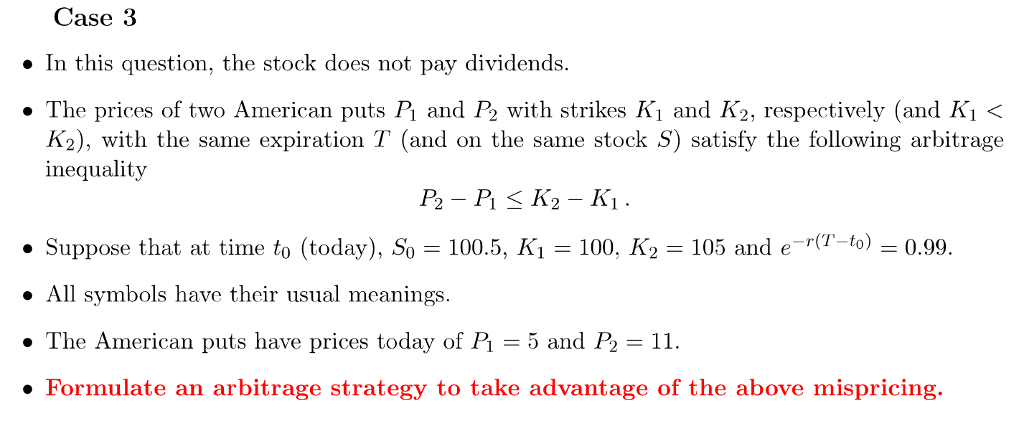

Case 3 In this question, the stock does not pay dividends. The prices of two American puts P1 and P2 with strikes Ki and K2, respectively (and Ki ? K2), with the same expiration T (and on the same stock S) satisfy the following arbitrage inequality 1005, K,-100, K2 = 105 and e-r (T-to) . Suppose that at time to (today), So All symbols have their usual meanings. The American puts have prices today of 0.99. = 5 and P2 = 11. Formulate an arbitrage strategy to take advantage of the above mispricing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts