Question: Please explain clearly about why we use this step and is there any other steps? I will rate if it is clear 1. Company XYZ

Please explain clearly about why we use this step and is there any other steps? I will rate if it is clear

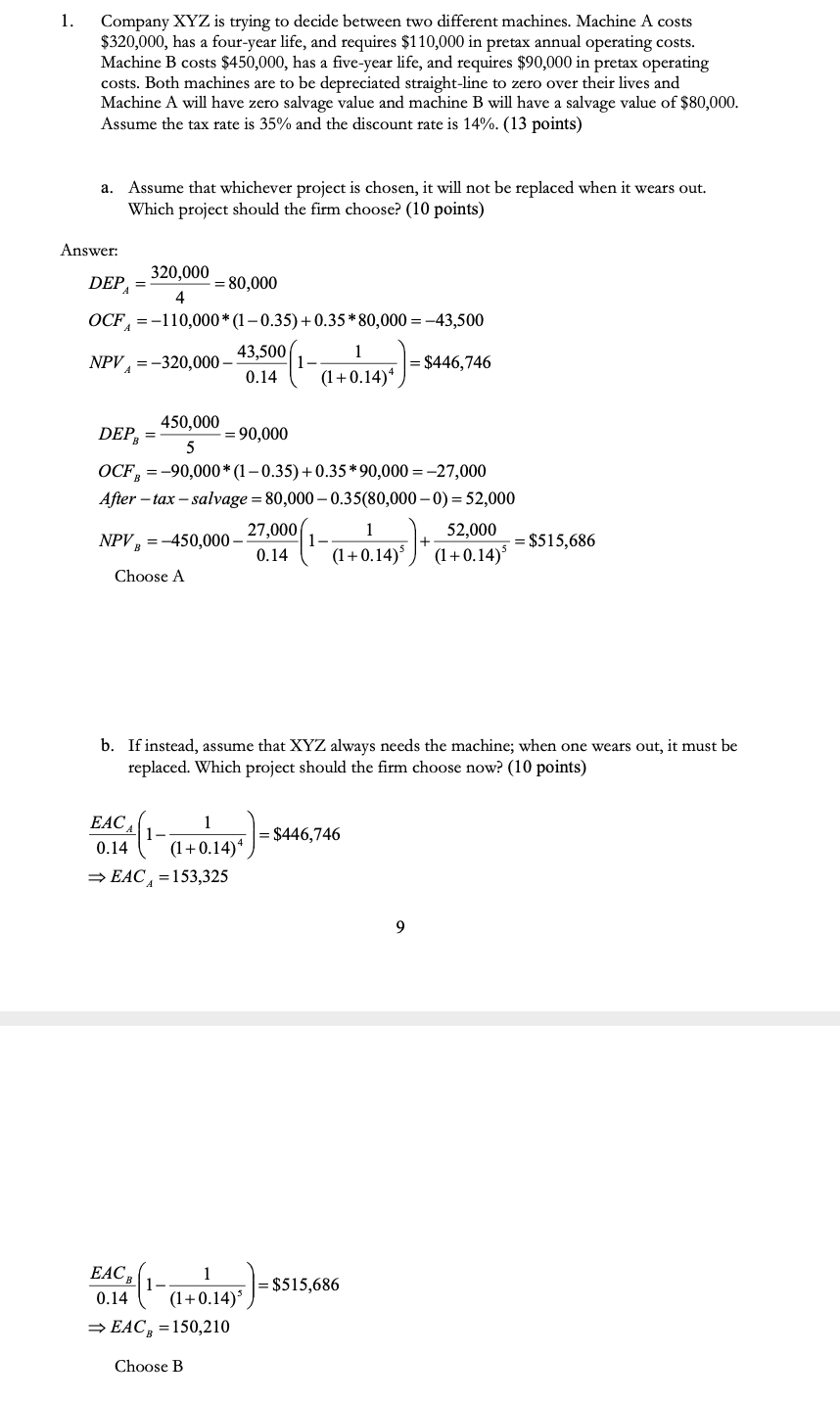

1. Company XYZ is trying to decide between two different machines. Machine A costs $320,000, has a four-year life, and requires $110,000 in pretax annual operating costs. Machine B costs $450,000, has a five-year life, and requires $90,000 in pretax operating costs. Both machines are to be depreciated straight-line to zero over their lives and Machine A will have zero salvage value and machine B will have a salvage value of $80,000. Assume the tax rate is 35% and the discount rate is 14%. (13 points) a. Assume that whichever project is chosen, it will not be replaced when it wears out. Which project should the firm choose? (10 points) Answer: DEP, = 320,000 = 80,000 4 OCFA = -110,000 *(1 -0.35) +0.35*80,000 = -43,500 43,500 NPV = -320,000 - = $446,746 0.14 (1+0.14)* 1 450,000 DEP = = 90,000 5 OCF, = -90,000*(1-0.35) +0.35 * 90,000 = -27,000 After - tax -salvage = 80,000 - 0.35(80,000 - 0) = 52,000 27,000 52,000 NPV =-450,000 - 1- = $515,686 0.14 (1+0.14) (1+0.14) Choose A b. If instead, assume that XYZ always needs the machine; when one wears out, it must be replaced. Which project should the firm choose now? (10 points) 1 $446,746 EAC 0.14 (1 +0.14) =EACA = 153,325 9 1 (telj) = $515,686 EAC 0.14 (1+0.14) = EAC) = 150,210 Choose B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts