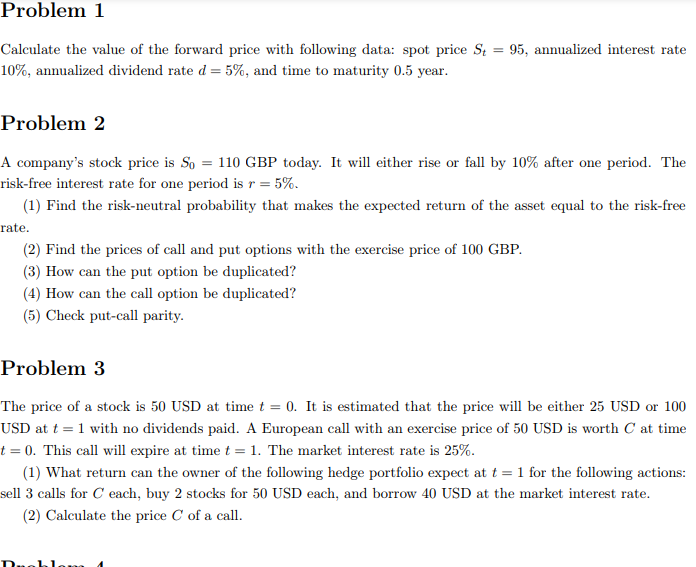

Question: Problem 1 = 95, annualized interest rate Calculate the value of the forward price with following data: spot price S 10%, annualized dividend rate d=5%,

Problem 1 = 95, annualized interest rate Calculate the value of the forward price with following data: spot price S 10%, annualized dividend rate d=5%, and time to maturity 0.5 year. Problem 2 A company's stock price is So = 110 GBP today. It will either rise or fall by 10% after one period. The risk-free interest rate for one period is r = 5%. (1) Find the risk-neutral probability that makes the expected return of the asset equal to the risk-free rate. (2) Find the prices of call and put options with the exercise price of 100 GBP. (3) How can the put option be duplicated? (4) How can the call option be duplicated? (5) Check put-call parity. Problem 3 The price of a stock is 50 USD at time t = 0. It is estimated that the price will be either 25 USD or 100 USD at t = 1 with no dividends paid. A European call with an exercise price of 50 USD is worth C at time t = 0. This call will expire at time t = 1. The market interest rate is 25%. (1) What return can the owner of the following hedge portfolio expect at t = 1 for the following actions: sell 3 calls for each, buy 2 stocks for 50 USD each, and borrow 40 USD at the market interest rate. (2) Calculate the price of a call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts