Question: please explain each answer Exercise 4-Intangible assets. (26 points) On December 31, 2018, the Harley Company had purchases of intangible assets OR research and development

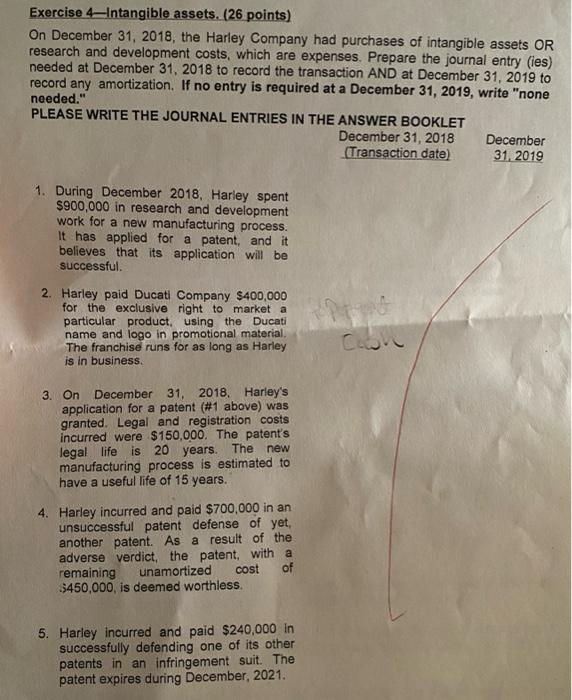

Exercise 4-Intangible assets. (26 points) On December 31, 2018, the Harley Company had purchases of intangible assets OR research and development costs, which are expenses. Prepare the journal entry (ies) needed at December 31, 2018 to record the transaction AND at December 31, 2019 to record any amortization. If no entry is required at a December 31, 2019, write "none needed." PLEASE WRITE THE JOURNAL ENTRIES IN THE ANSWER BOOKLET December 31, 2018 December (Transaction date) 31, 2019 1. During December 2018, Harley spent $900,000 in research and development work for a new manufacturing process. It has applied for a patent, and it believes that its application will be successful 2. Harley paid Ducati Company $400,000 for the exclusive right to market a particular product using the Ducati name and logo in promotional material The franchise runs for as long as Harley is in business 3. On December 31, 2018, Harley's application for a patent (#1 above) was granted. Legal and registration costs incurred were $150,000. The patent's legal life is 20 years. The new manufacturing process is estimated to have a useful life of 15 years. 4. Harley incurred and paid $700,000 in an unsuccessful patent defense of yet, another patent. As a result of the adverse verdict, the patent, with a remaining unamortized cost of 5450,000, is deemed worthless. 5. Harley incurred and paid $240,000 in successfully defending one of its other patents in an infringement suit. The patent expires during December, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts