Question: Please explain each step as i would like to learn how to get the answer. especially if you use excel. Thank you in advance! if

Please explain each step as i would like to learn how to get the answer. especially if you use excel. Thank you in advance! if correct ill thumbs up:)

Please explain each step as i would like to learn how to get the answer. especially if you use excel. Thank you in advance! if correct ill thumbs up:)

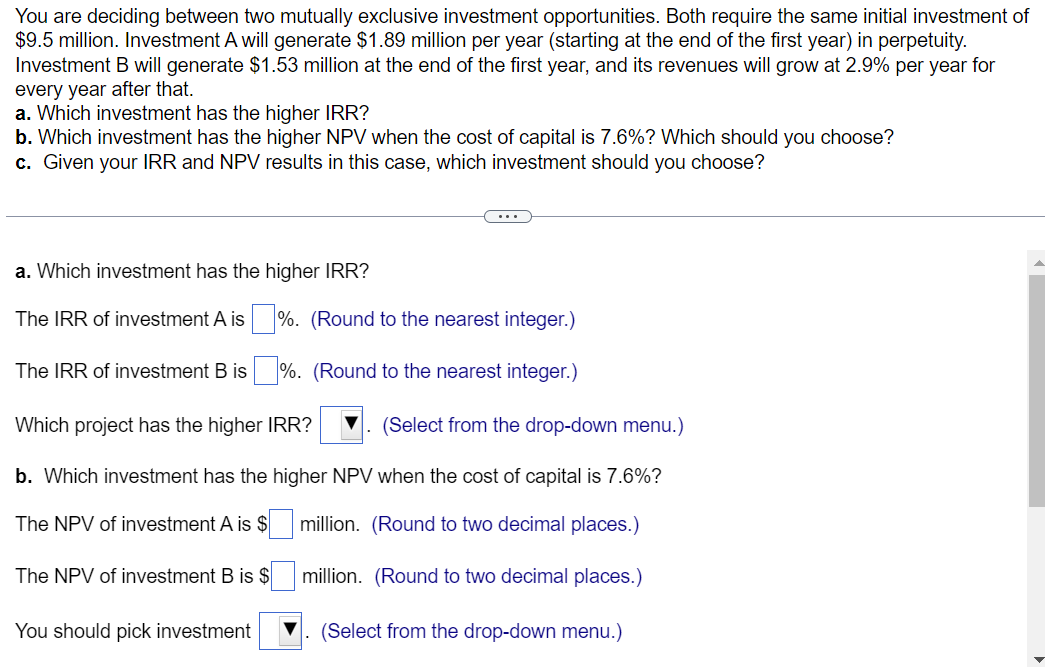

You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of \$9.5 million. Investment A will generate $1.89 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.53 million at the end of the first year, and its revenues will grow at 2.9% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 7.6% ? Which should you choose? c. Given your IRR and NPV results in this case, which investment should you choose? a. Which investment has the higher IRR? The IRR of investment A is %. (Round to the nearest integer.) The IRR of investment B is %. (Round to the nearest integer.) Which project has the higher IRR? (Select from the drop-down menu.) b. Which investment has the higher NPV when the cost of capital is 7.6% ? The NPV of investment A is $ million. (Round to two decimal places.) The NPV of investment B is $ million. (Round to two decimal places.) You should pick investment (Select from the drop-down menu.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts