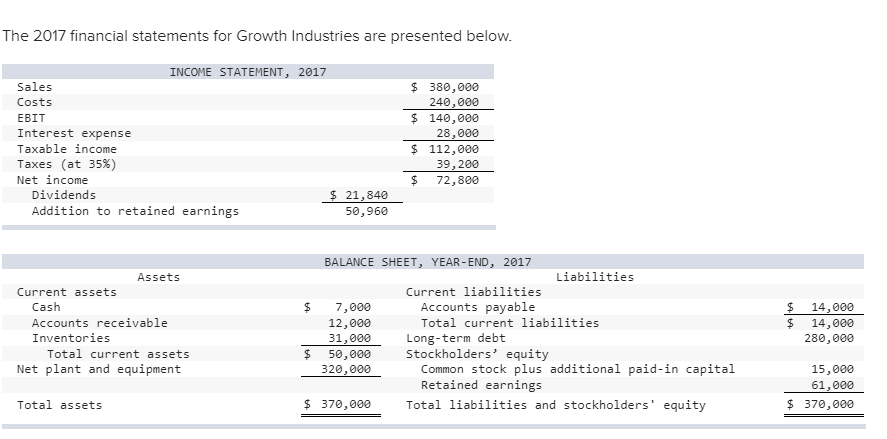

Question: This is my third attempt to get this question answer by a tutor :-( Sales and costs are projected to grow at 20% a year

This is my third attempt to get this question answer by a tutor :-(

Sales and costs are projected to grow at 20% a year for at least the next 4 years. Both current assets and accounts payable are projected to rise in proportion to sales. The firm is currently operating at 75% capacity, so it plans to increase fixed assets in proportion to sales. Interest expense will equal 10% of long-term debt outstanding at the start of the year. The firm will maintain a dividend payout ratio of 0.30.

What is the required external financing over the next year? (Negative amounts should be indicated by a minus sign.)

External financing= ( Answer should be a negative amount)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts