Question: Please explain every step, and Round the final answer to 4 decimal places. Question 4 The price of IDO stock is currently $80. In the

Please explain every step, and Round the final answer to 4 decimal places.

Please explain every step, and Round the final answer to 4 decimal places.

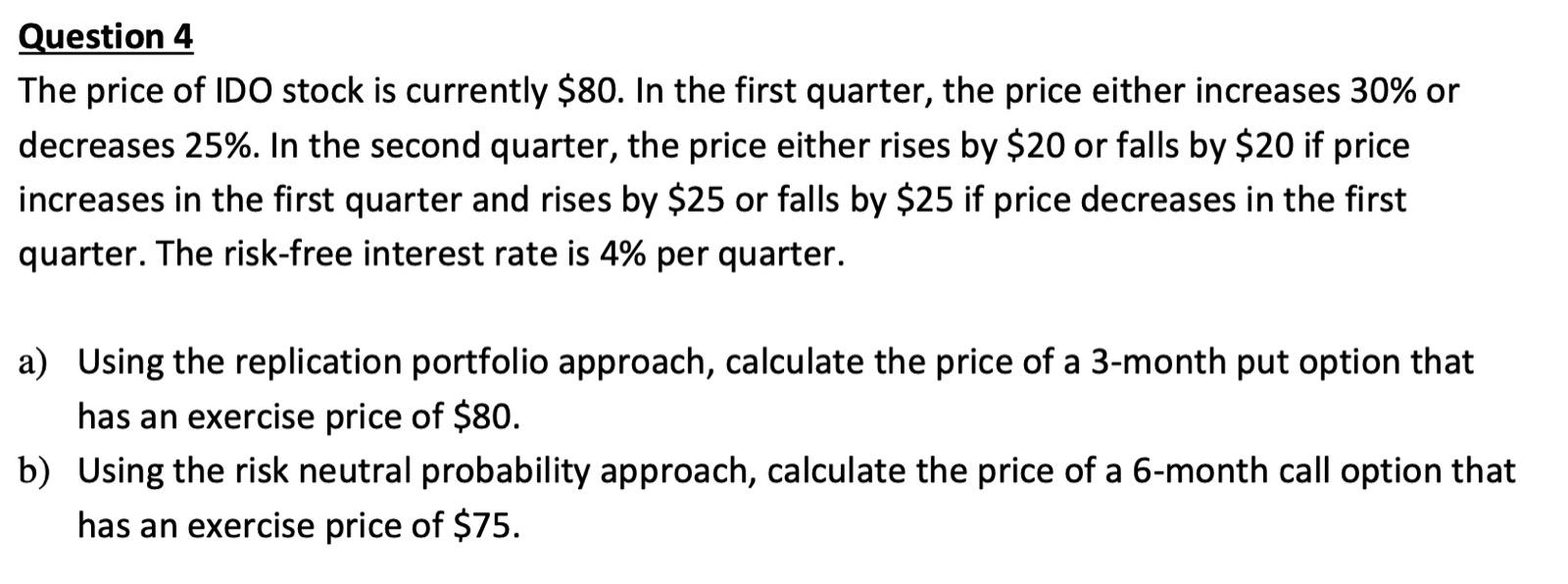

Question 4 The price of IDO stock is currently $80. In the first quarter, the price either increases 30% or decreases 25%. In the second quarter, the price either rises by $20 or falls by $20 if price increases in the first quarter and rises by $25 or falls by $25 if price decreases in the first quarter. The risk-free interest rate is 4% per quarter. a) Using the replication portfolio approach, calculate the price of a 3-month put option that has an exercise price of $80. b) Using the risk neutral probability approach, calculate the price of a 6-month call option that has an exercise price of $75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts