Question: Please explain Exercise 18-26B Computing absorption costing income LO P!5 A manufacturer reports the information below for three recent years Variable costing income Beginning finished

Please explain

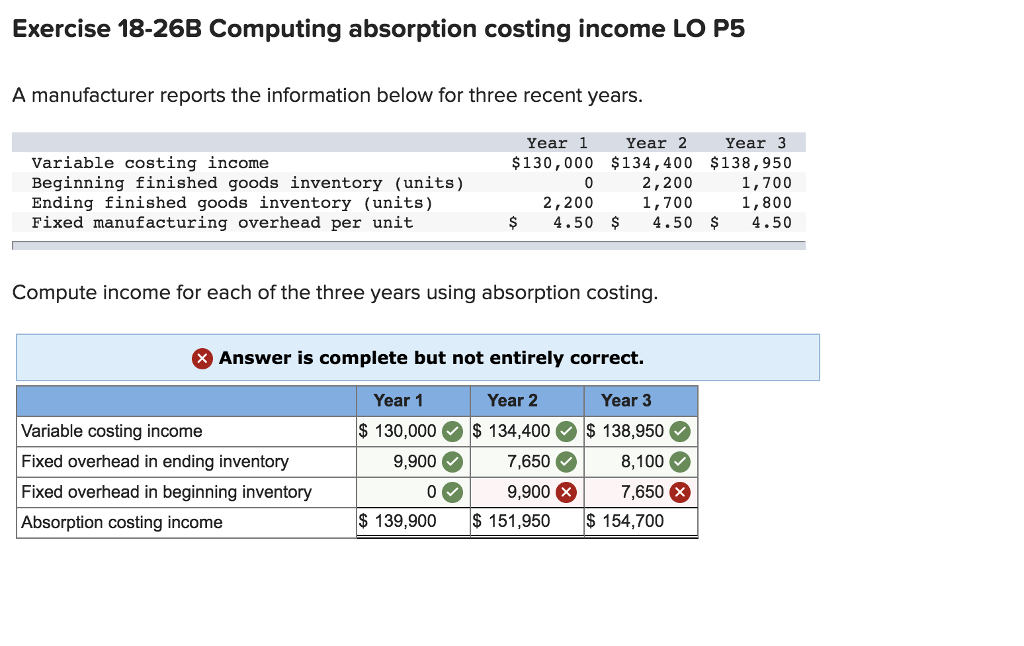

Exercise 18-26B Computing absorption costing income LO P!5 A manufacturer reports the information below for three recent years Variable costing income Beginning finished goods inventory (units) Ending finished goods inventory (units) Fixed manufacturing overhead per unit Year 1 Year 2 Year 3 $130,000 $134,400 $138,950 1,700 1,800 $4.50 $4.50 4.50 2,200 1,700 2,200 Compute income for each of the three years using absorption costing. Answer is complete but not entirely correct. Year 2 Year 3 $ 130,000 134,400 S 138,950 8,100 7,650 $139,900 151,950$ 154,700 Year 1 Variable costing income Fixed overhead in ending inventory Fixed overhead in beginning inventory Absorption costing income 7,650 9,900 9,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts