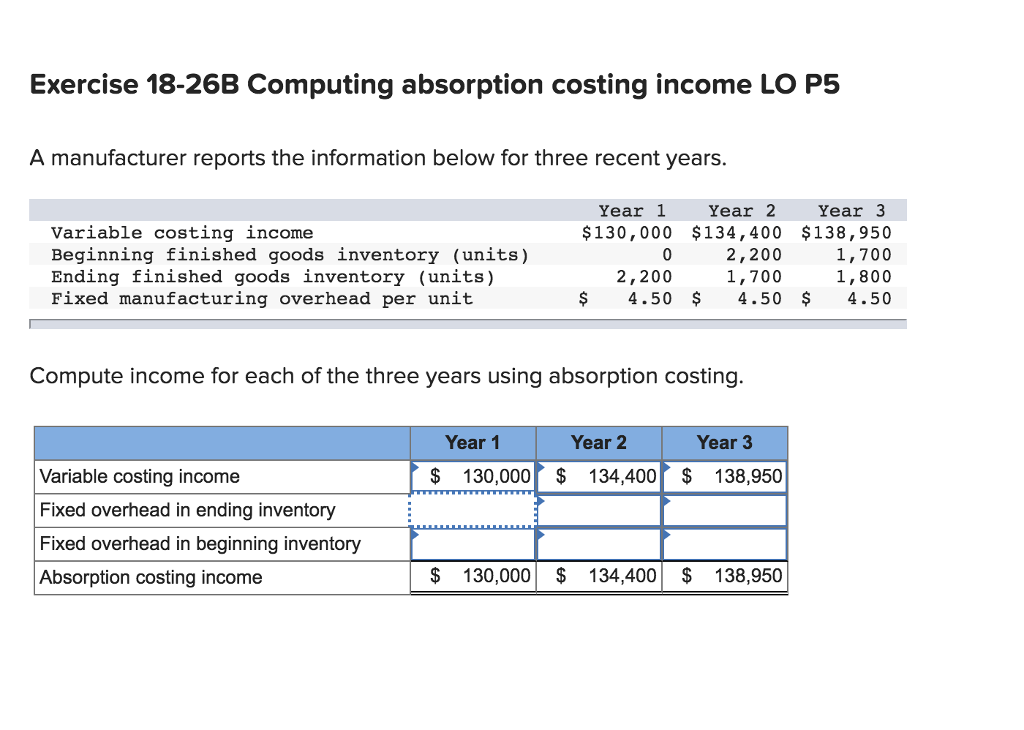

Question: Please explain Exercise 18-26B Computing absorption costing income LO P!5 A manufacturer reports the information below for three recent years. Year 3 $130,000 $134,400 $138,950

Please explain

Exercise 18-26B Computing absorption costing income LO P!5 A manufacturer reports the information below for three recent years. Year 3 $130,000 $134,400 $138,950 1,700 1,800 $4.504.50 $4.50 Year 1 Year 2 Variable costing income Beginning finished goods inventory (units) Ending finished goods inventory (units) Fixed manufacturing overhead per unit 2,200 1,700 2,200 Compute income for each of the three years using absorption costing Year 1 Year 2 Year 3 $ 130,00o 134,400 $ 138,950 Variable costing income Fixed overhead in ending inventory Fixed overhead in beginning inventory Absorption costing income $ 130,000$ 134,400 138,950

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts