Question: please explain how did you get the answer thanks 2. Evaluate the appropriateness of the sources and funds to support the company's financial needs. Using

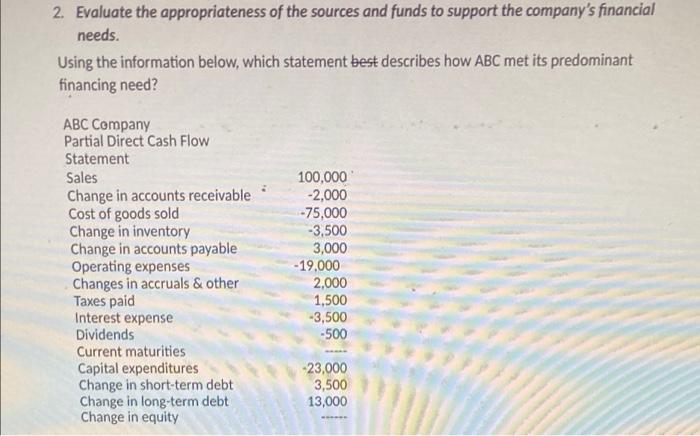

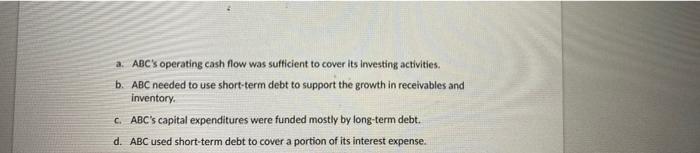

2. Evaluate the appropriateness of the sources and funds to support the company's financial needs. Using the information below, which statement best describes how ABC met its predominant financing need? ABC Company Partial Direct Cash Flow Statement Sales Change in accounts receivable Cost of goods sold Change in inventory Change in accounts payable Operating expenses Changes in accruals & other Taxes paid Interest expense Dividends Current maturities Capital expenditures Change in short-term debt Change in long-term debt Change in equity 100,000 -2,000 -75,000 -3,500 3,000 -19.000 2,000 1,500 -3,500 -500 23,000 3,500 13,000 a. ABC's operating cash flow was sufficient to cover its investing activities. b. ABC needed to use short-term debt to support the growth in receivables and inventory c. ABC's capital expenditures were funded mostly by long-term debt. d. ABC used short-term debt to cover a portion of its interest expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts