Question: Please explain how the Spot Exchange Rate is $0.8293 & the Forward Rate is $0.8383 per the explanation highlighted below? Show correct answers 3 James

Please explain how the Spot Exchange Rate is $0.8293 & the Forward Rate is $0.8383 per the explanation highlighted below?

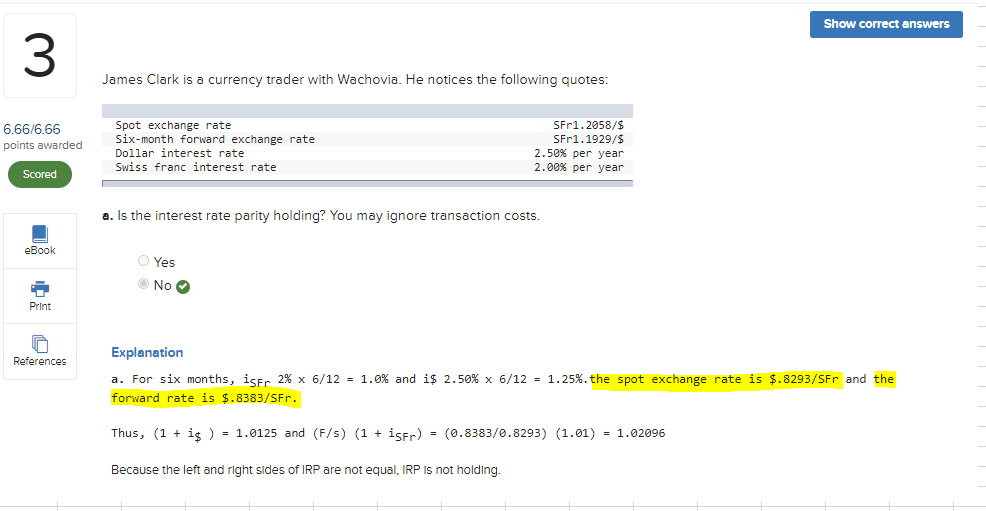

Show correct answers 3 James Clark is a currency trader with Wachovia. He notices the following quotes: 6.66/6.66 points awarded Spot exchange rate Six-month forward exchange rate Dollar interest rate Swiss franc interest rate SFr1.2058/$ SFr1.1929/$ 2.50% per year 2.00% per year Scored a. Is the interest rate parity holding? You may ignore transaction costs. eBook Yes 0 No Print References Explanation a. For six months, isfr 2% x 6/12 = 1.0% and i$ 2.50% * 6/12 = 1.25%. the spot exchange rate is $.8293/SFr and the forward rate is $.8383/SFr. Thus, (1 + i ) = 1.0125 and (F/s) (1 + isfr) = (0.8383/0.8293) (1.01) = 1.02096 Because the left and right sides of IRP are not equal, IRP is not holding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts