Question: Please explain how to calculate The tax is section, using a formula. It's mid-December and Marie is finalizing her divorce. Generally, she and her soon

Please explain how to calculate The tax is section, using a formula.

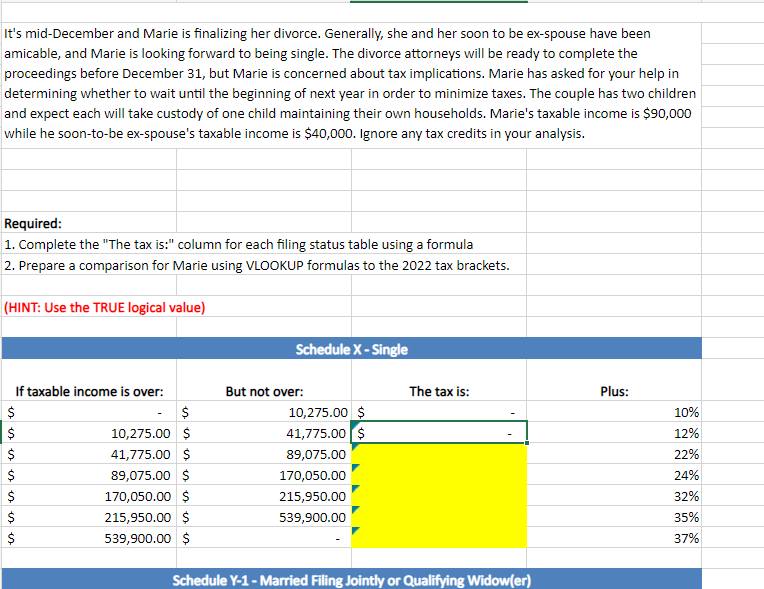

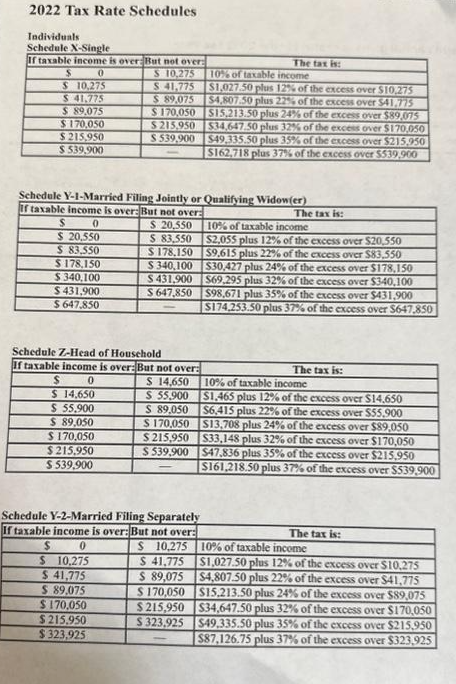

It's mid-December and Marie is finalizing her divorce. Generally, she and her soon to be ex-spouse have been amicable, and Marie is looking forward to being single. The divorce attorneys will be ready to complete the proceedings before December 31, but Marie is concerned about tax implications. Marie has asked for your help in determining whether to wait until the beginning of next year in order to minimize taxes. The couple has two children and expect each will take custody of one child maintaining their own households. Marie's taxable income is $90,000 while he soon-to-be ex-spouse's taxable income is $40,000. Ignore any tax credits in your analysis. Required: 1. Complete the "The tax is:" column for each filing status table using a formula 2. Prepare a comparison for Marie using VLOOKUP formulas to the 2022 tax brackets. (HINT: Use the TRUE logical value) \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Schedule X-Single } \\ \hline \multicolumn{2}{|c|}{ If taxable income is over: } & \multicolumn{2}{|c|}{ But not over: } & The tax is: & Plus: \\ \hline$ & - & $ & 10,275.00 & $ & 10% \\ \hline$ & 10,275.00 & $ & 41,775.00 & $ & 12% \\ \hline$ & 41,775.00 & \$ & 89,075.00 & & 22% \\ \hline$ & 89,075.00 & $ & 170,050.00 & r & 24% \\ \hline$ & 170,050.00 & $ & 215,950.00 & r & 32% \\ \hline$ & 215,950.00 & $ & 539,900.00 & r & 35% \\ \hline$ & 539,900.00 & $ & - & & 37% \\ \hline \end{tabular} Schedule Y-1 - Married Filing Jointly or Qualifying Widow(er) 2022 Tax Rate Schedules Individuals Sohodula V-sionte. It's mid-December and Marie is finalizing her divorce. Generally, she and her soon to be ex-spouse have been amicable, and Marie is looking forward to being single. The divorce attorneys will be ready to complete the proceedings before December 31, but Marie is concerned about tax implications. Marie has asked for your help in determining whether to wait until the beginning of next year in order to minimize taxes. The couple has two children and expect each will take custody of one child maintaining their own households. Marie's taxable income is $90,000 while he soon-to-be ex-spouse's taxable income is $40,000. Ignore any tax credits in your analysis. Required: 1. Complete the "The tax is:" column for each filing status table using a formula 2. Prepare a comparison for Marie using VLOOKUP formulas to the 2022 tax brackets. (HINT: Use the TRUE logical value) \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Schedule X-Single } \\ \hline \multicolumn{2}{|c|}{ If taxable income is over: } & \multicolumn{2}{|c|}{ But not over: } & The tax is: & Plus: \\ \hline$ & - & $ & 10,275.00 & $ & 10% \\ \hline$ & 10,275.00 & $ & 41,775.00 & $ & 12% \\ \hline$ & 41,775.00 & \$ & 89,075.00 & & 22% \\ \hline$ & 89,075.00 & $ & 170,050.00 & r & 24% \\ \hline$ & 170,050.00 & $ & 215,950.00 & r & 32% \\ \hline$ & 215,950.00 & $ & 539,900.00 & r & 35% \\ \hline$ & 539,900.00 & $ & - & & 37% \\ \hline \end{tabular} Schedule Y-1 - Married Filing Jointly or Qualifying Widow(er) 2022 Tax Rate Schedules Individuals Sohodula V-sionte

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts