Question: please explain how to do each problem step by step using the baii plus calculator, or handwritten formulas are preferred. no excel please, thank you!

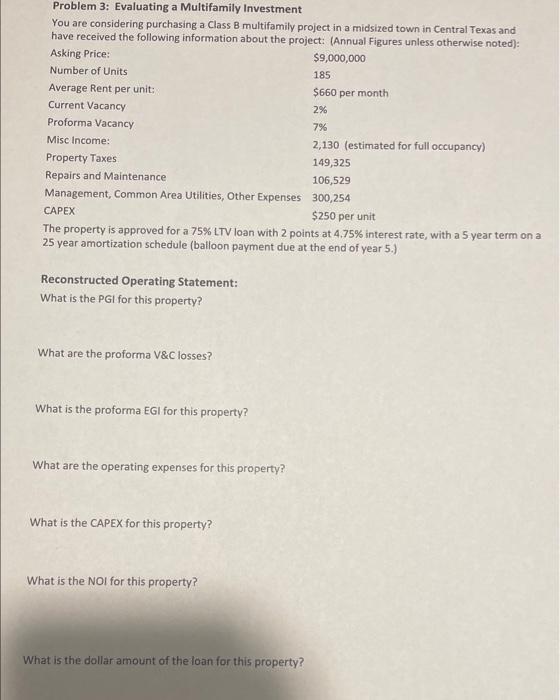

Problem 3: Evaluating a Multifamily Investment You are considering purchasing a Class B multifamily project in a midsized town in Central Texas and have received the following information about the project: (Annual Figures unless otherwise noted): The property is approved for a 75% LTV loan with 2 points at 4.75% interest rate, with a 5 year term on a 25 year amortization schedule (balloon payment due at the end of year 5 .) Reconstructed Operating Statement: What is the PGI for this property? What are the proforma V\&C losses? What is the proforma EGI for this property? What are the operating expenses for this property? What is the CAPEX for this property? What is the NOI for this property? What is the dollar amount of the loan for this property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts