Question: PLEASE EXPLAIN HOW TO DO IT STEP BY STEP EXCEL Unanswered Question 6 0/5 pts You work for a firm that reports the following: $450,000

PLEASE EXPLAIN HOW TO DO IT STEP BY STEP EXCEL

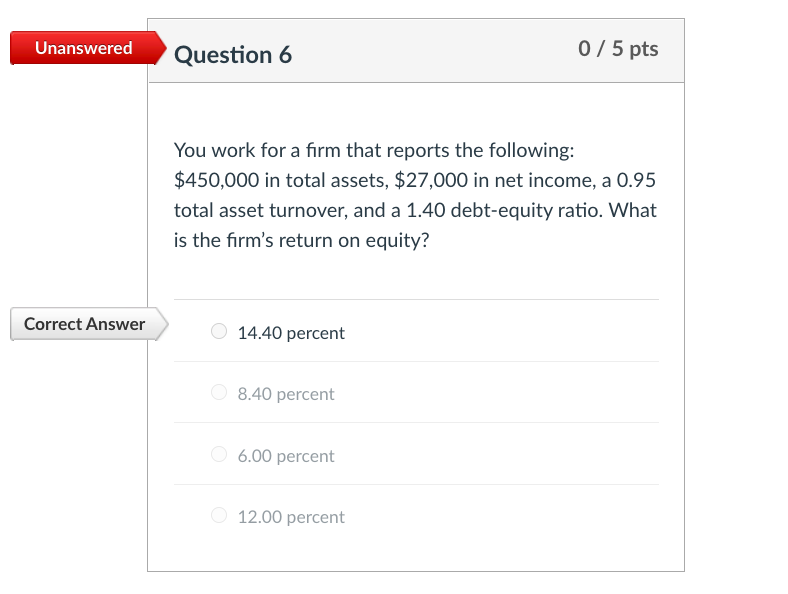

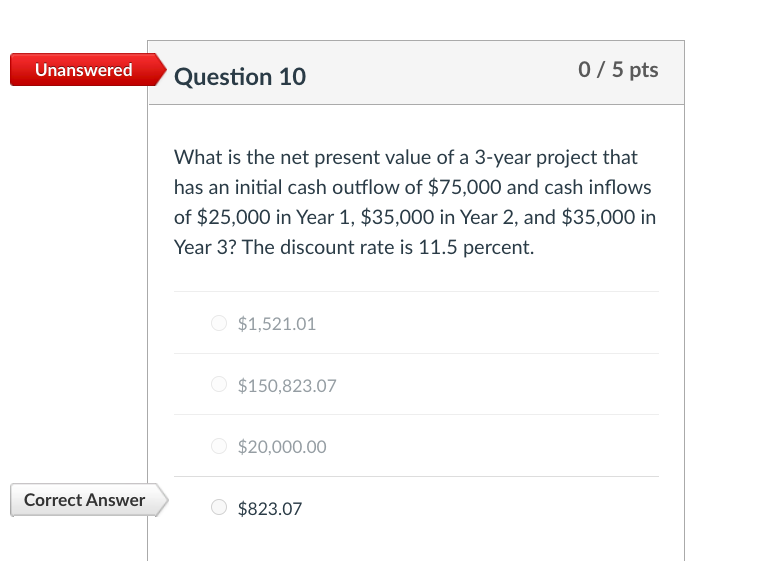

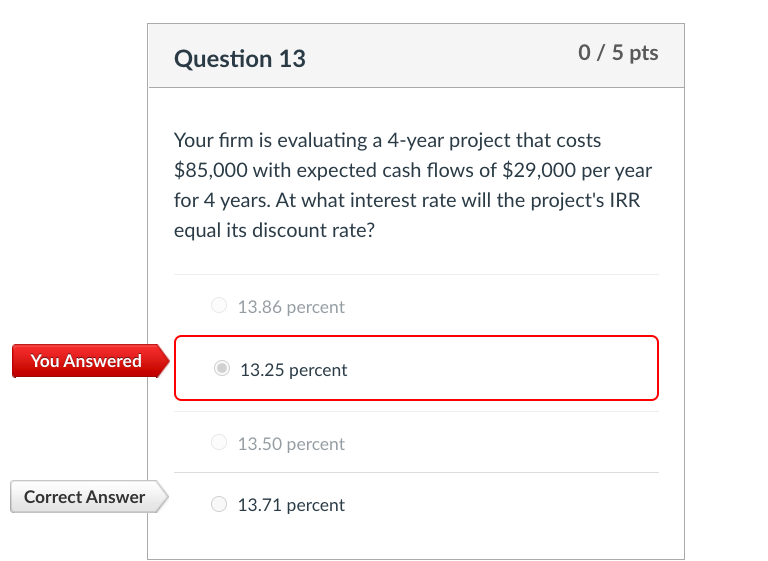

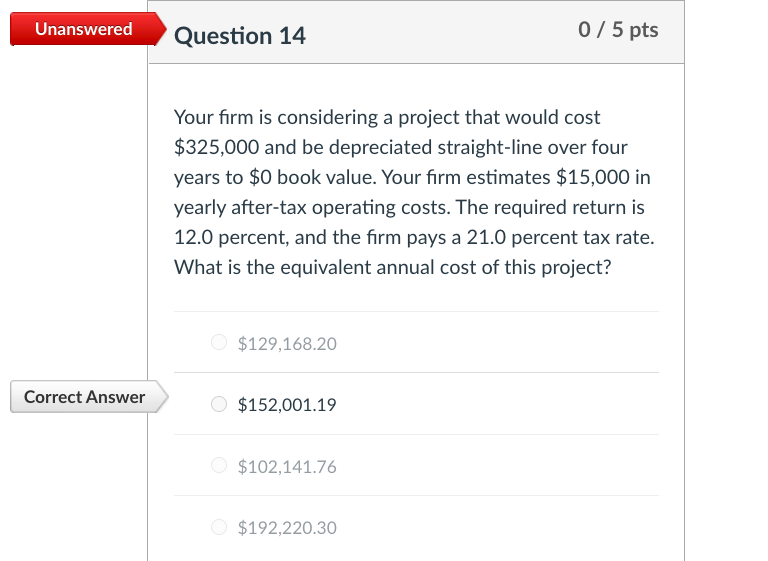

Unanswered Question 6 0/5 pts You work for a firm that reports the following: $450,000 in total assets, $27,000 in net income, a 0.95 total asset turnover, and a 1.40 debt-equity ratio. What is the firm's return on equity? Correct Answer 14.40 percent 8.40 percent 6.00 percent 12.00 percent Unanswered Question 10 0/5 pts What is the net present value of a 3-year project that has an initial cash outflow of $75,000 and cash inflows of $25,000 in Year 1, $35,000 in Year 2, and $35,000 in Year 3? The discount rate is 11.5 percent. $1,521.01 $150,823.07 $20,000.00 Correct Answer $823.07 Question 13 0/5 pts Your firm is evaluating a 4-year project that costs $85,000 with expected cash flows of $29,000 per year for 4 years. At what interest rate will the project's IRR equal its discount rate? 13.86 percent You Answered 13.25 percent 13.50 percent Correct Answer 13.71 percent Unanswered 0/5 pts Question 14 Your firm is considering a project that would cost $325,000 and be depreciated straight-line over four years to $0 book value. Your firm estimates $15,000 in yearly after-tax operating costs. The required return is 12.0 percent, and the firm pays a 21.0 percent tax rate. What is the equivalent annual cost of this project? $129,168.20 Correct Answer $152,001.19 $102,141.76 $192,220.30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts