Question: please explain how to do problems on a financial calculator (BA II Plus) if possible! You will deposit $150 each of the next five years

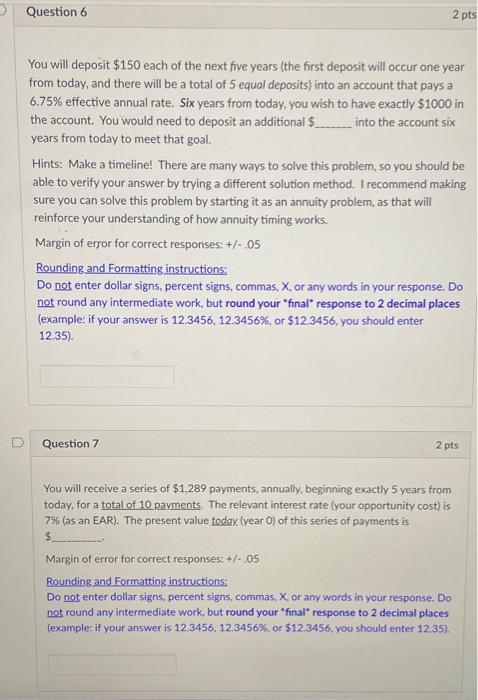

You will deposit $150 each of the next five years (the first deposit will occur one year from today, and there will be a total of 5 equal deposits) into an account that pays a 6.75% effective annual rate. Six years from today, you wish to have exactly $1000 in the account. You would need to deposit an additional $ into the account six years from today to meet that goal. Hints: Make a timeline! There are many ways to solve this problem, so you should be able to verify your answer by trying a different solution method. I recommend making sure you can solve this problem by starting it as an annuity problem, as that will reinforce your understanding of how annuity timing works. Margin of error for correct responses: +/.05 Rounding and Formatting instructions: Do net enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your "final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). Question 7 2 pts You will receive a series of $1,289 payments, annually, beginning exactly 5 years from today, for a total of 10 payments. The relevant interest rate (your opportunity cost) is 7% (as an EAR). The present value today. (year 0 ) of this series of payments is $ Margin of error for correct responses: +/.05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your "final" response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts