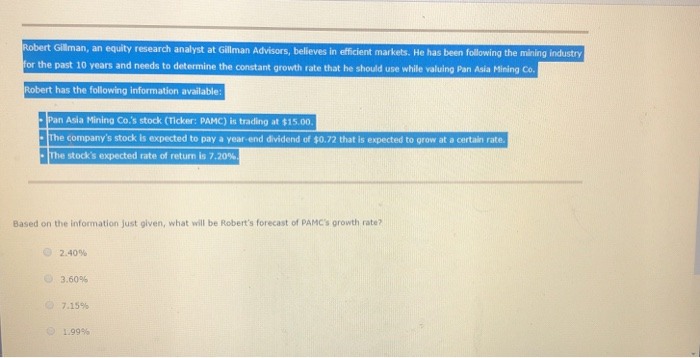

Question: please explain how to do this Robert Giliman, an equity research analyst at Gillman Advisors, believes in efficient markets. He has been following the mining

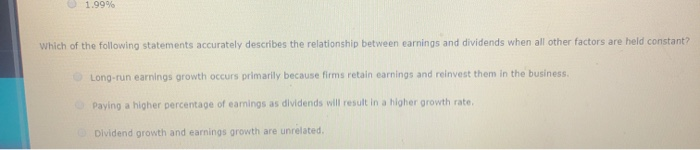

Robert Giliman, an equity research analyst at Gillman Advisors, believes in efficient markets. He has been following the mining industry for the past 10 years and needs to determine the constant growth rate that he should use while valuing Pan Asia Mining Co Robert has the following information available: Pan Asia Mining Co.'s stock (Ticker: PAMC) is trading at $15.00 o the company's stock is expected to pay a year end dividend of 30.72 that is expected to grow at a certain rate The stock's expected rate of return is 7.20% Based on the information just given, what will be Robert's forecast of PAMCS growth rate? 2.40% 3.60 7.15% 1.99% Which of the following statements accurately describes the relationship between earnings and dividends when all other factors are held constant? Long-run earnings growth occurs primarily because firms retain earnings and reinvest them in the business, Paying a higher percentage of eamings as dividends will result in a higher growth rate Dividend growth and earnings growth are unrelated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts