Question: Please explain how to figure out question A regarding the horizon value of free cash flows: 12. Croyontech Inc has forecasted its free cash flows

Please explain how to figure out question A regarding the horizon value of free cash flows:

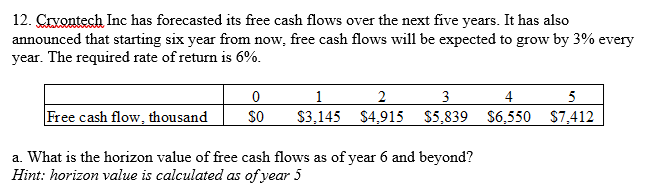

12. Croyontech Inc has forecasted its free cash flows over the next five years. It has also announced that starting six year from now, free cash flows will be expected to grow by 3% every year. The required rate of return is 6%. a. What is the horizon value of free cash flows as of year 6 and beyond? Hint: horizon value is calculated as of year 5

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock