Question: please explain how to find the expected payoff, please explain it in details! thank u so much The owner of Pearl Automotive Dealers is trying

please explain how to find the expected payoff, please explain it in details! thank u so much

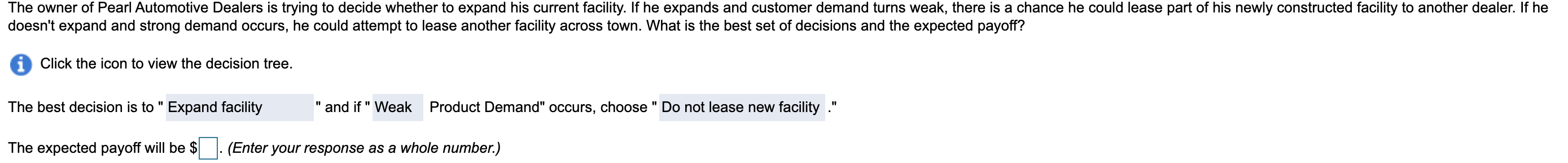

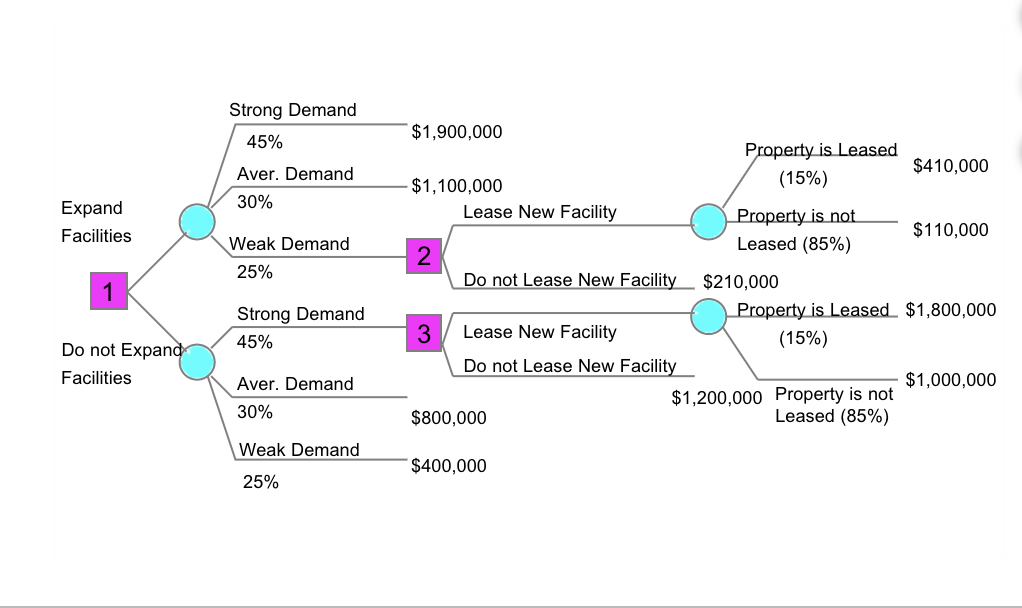

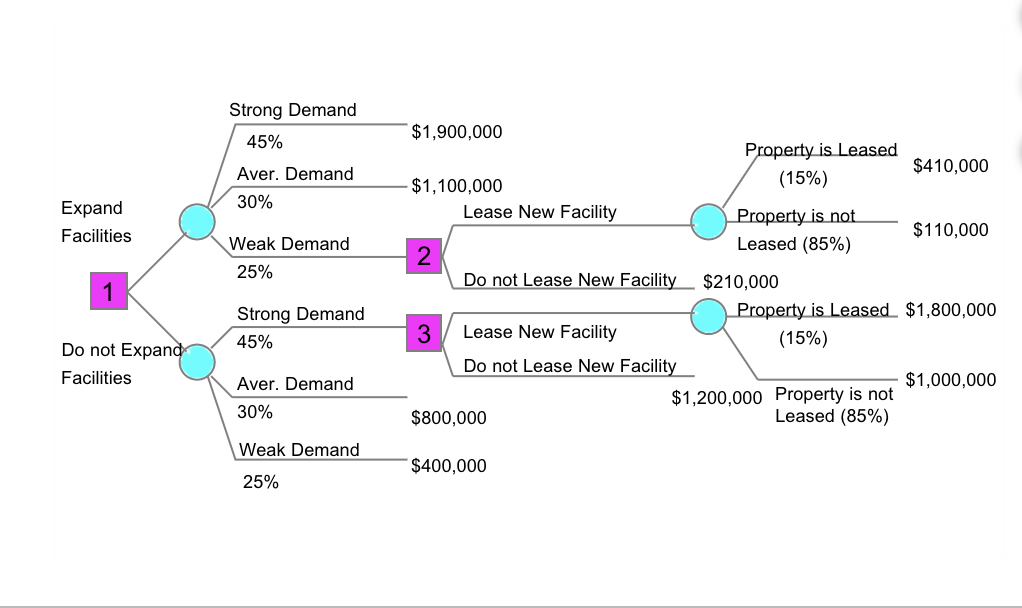

The owner of Pearl Automotive Dealers is trying to decide whether to expand his current facility. If he expands and customer demand turns weak, there is a chance he could lease part of his newly constructed facility to another dealer. If he doesn't expand and strong demand occurs, he could attempt to lease another facility across town. What is the best set of decisions and the expected payoff? i Click the icon to view the decision tree. The best decision is to " Expand facility and if" Weak Product Demand" occurs, choose "Do not lease new facility." The expected payoff will be $ (Enter your response as a whole number.) Strong Demand 45% Aver. Demand 30% Expand Facilities Weak Demand 25% $1,900,000 Property is Leased $410,000 $1,100,000 (15%) Lease New Facility Property is not $110,000 Leased (85%) 2 Do not Lease New Facility $210,000 Property is Leased $1,800,000 3 Lease New Facility (15%) Do not Lease New Facility $1,000,000 $1,200,000 Property is not $800,000 Leased (85%) 1 Strong Demand 45% Do not Expand Facilities Aver. Demand 30% Weak Demand $400,000 25%