Question: Please explain how to get 1.44 from the Problen explanation froinded. No need to do problem from the beginning, Just hou to get the ausuer

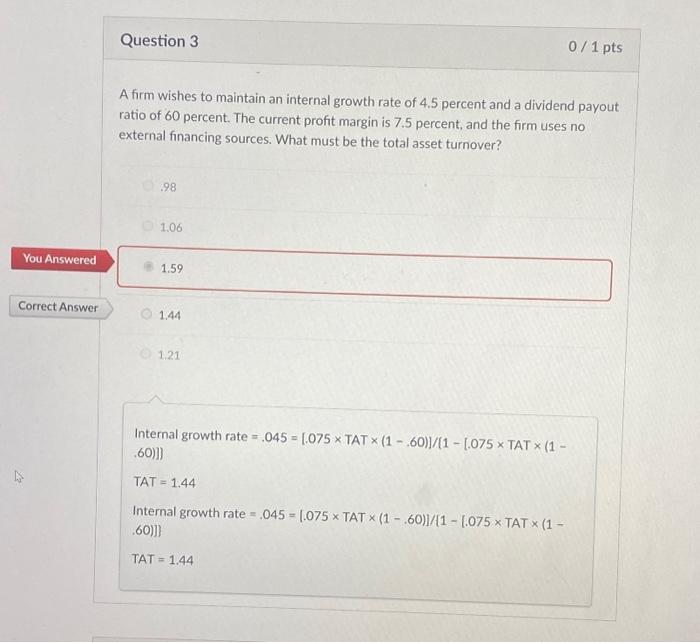

Please explain how to get 1.44 from the Problen explanation froinded. No need to do problem from the beginning, Just hou to get the ausuer From the Provided Step. A firm wishes to maintain an internal growth rate of 4.5 percent and a dividend payout ratio of 60 percent. The current profit margin is 7.5 percent, and the firm uses no external financing sources. What must be the total asset turnover? .98 1.06 1.59 1.44 1.21 Internal growth rate =.045=[.075 TAT (1.60)]/[1[.075 TAT (1 .60)]] TAT=1.44 Internal growth rate =.045=[.075 TAT (1.60)]/[1[.075 TAT (1 .60)]] TAT=1.44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts