Question: Please explain how to get answer. Do not answer If you are providing incorrect answers and formula. QUESTION 1 What is the yield-to-maturity of a

Please explain how to get answer. Do not answer If you are providing incorrect answers and formula.

Please explain how to get answer. Do not answer If you are providing incorrect answers and formula.

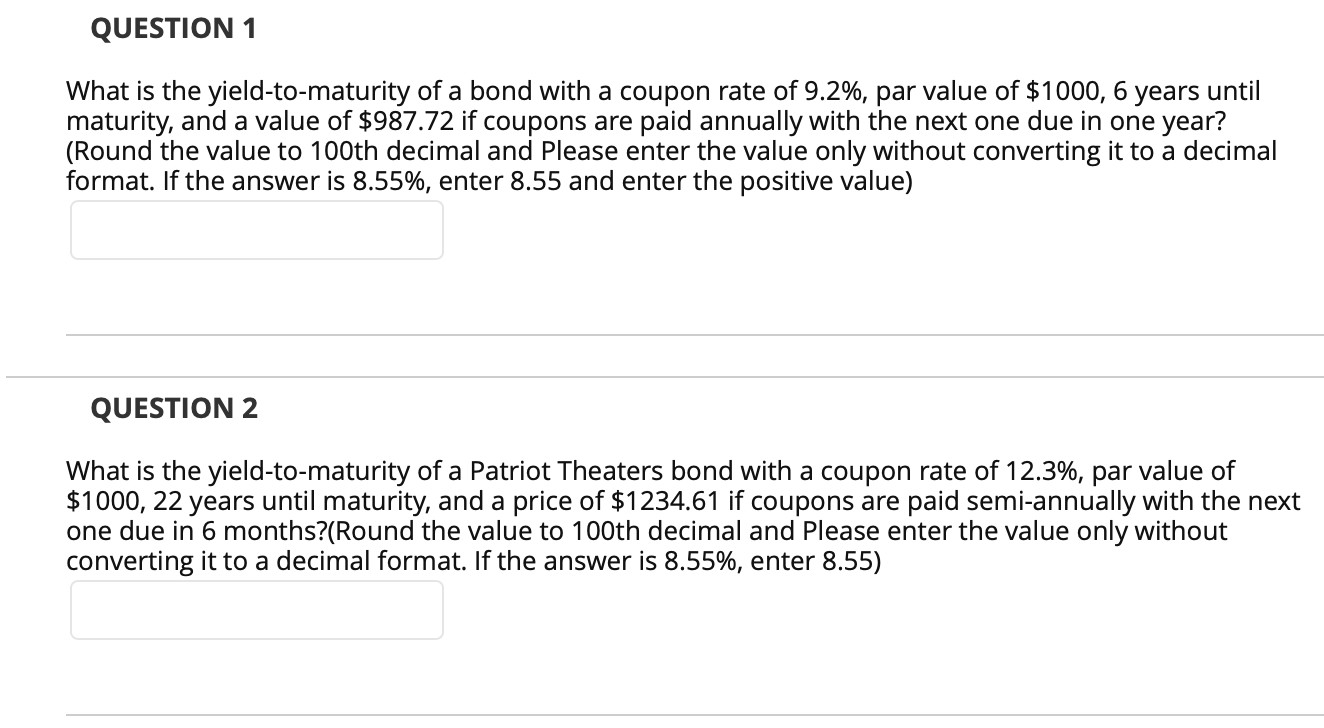

QUESTION 1 What is the yield-to-maturity of a bond with a coupon rate of 9.2%, par value of $1000, 6 years until maturity, and a value of $987.72 if coupons are paid annually with the next one due in one year? (Round the value to 100th decimal and Please enter the value only without converting it to a decimal format. If the answer is 8.55%, enter 8.55 and enter the positive value) QUESTION 2 What is the yield-to-maturity of a Patriot Theaters bond with a coupon rate of 12.3%, par value of $1000, 22 years until maturity, and a price of $1234.61 if coupons are paid semi-annually with the next one due in 6 months?(Round the value to 100th decimal and Please enter the value only without converting it to a decimal format. If the answer is 8.55%, enter 8.55)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts