Question: Please explain how to get answers for both with formulas. Thank you! . Question 9 In six months, a cereal company plans to sell 20,000

Please explain how to get answers for both with formulas. Thank you!

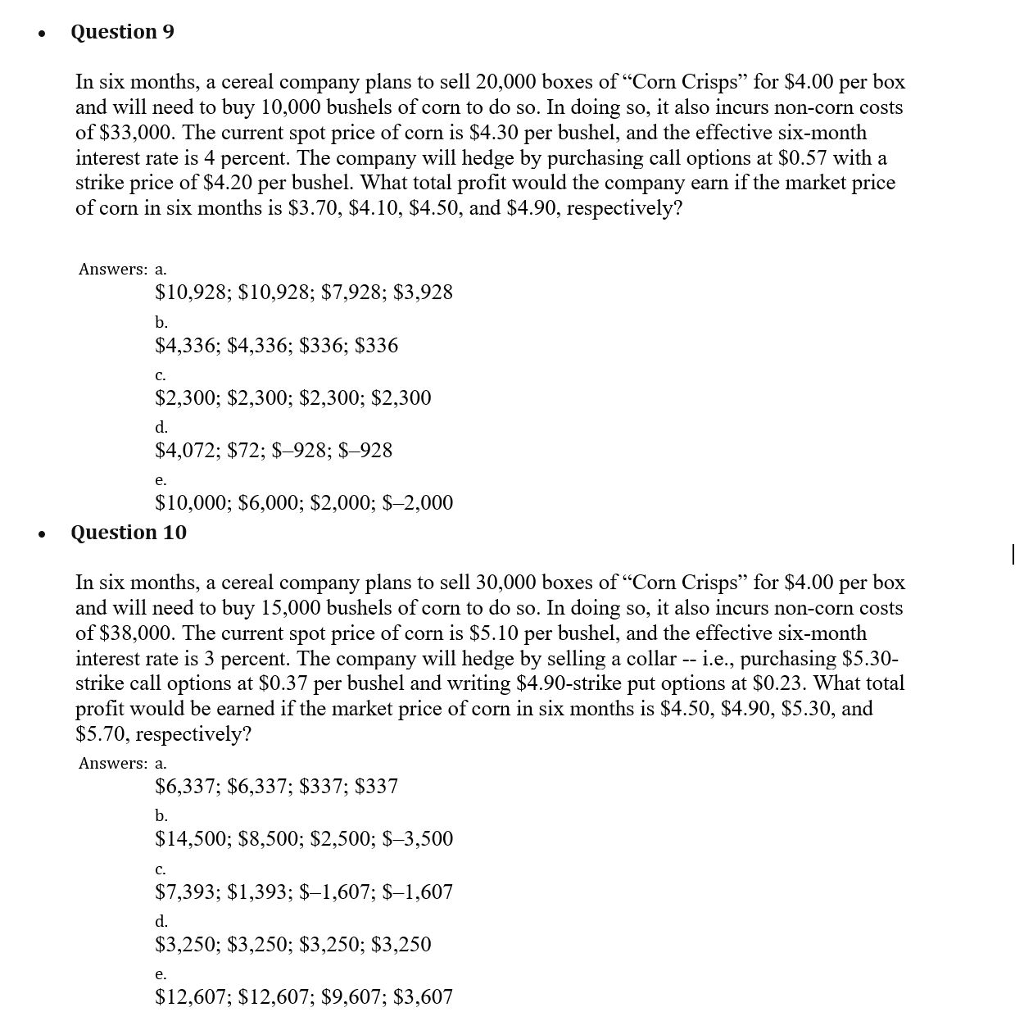

. Question 9 In six months, a cereal company plans to sell 20,000 boxes of "Corn Crisps" for $4.00 per box and will need to buy 10,000 bushels of corn to do so. In doing so, it also incurs non-corn costs of $33,000. The current spot price of corn is $4.30 per bushel, and the effective six-month interest rate is 4 percent. The company will hedge by purchasing call options at $0.57 with a strike price of $4.20 per bushel. What total profit would the company earn if the market price of corn in six months is $3.70, $4.10, $4.50, and $4.90, respectively? Answers: a $10,928; $10,928; $7,928; $3,928 $4,336; $4,336; $336; $336 C. $2,300; $2,300; $2,300; $2,300 d. $4,072; $72; $-928; $-928 $10,000; $6,000; $2,000; $-2,000 . Question 10 In six months, a cereal company plans to sell 30,000 boxes of "Corn Crisps" for $4.00 per box and will need to buy 15,000 bushels of corn to do so. In doing so, it also incurs non-corn costs of $38,000. The current spot price of corn is $5.10 per bushel, and the effective six-month interest rate is 3 percent. The company will hedge by selling a collar -- i.e., purchasing $5.30- strike call options at $0.37 per bushel and writing $4.90-strike put options at $0.23. What total profit would be earned if the market price of corn in six months is $4.50, $4.90, S5.30, and $5.70, respectively? Answers: a $6,337; $6,337; $337; $337 $14,500; $8,500; $2,500; $-3,500 C. $7,393; $1,393; $-1,607; $-1,607 d. $3,250; $3,250; $3,250; $3,250 $12,607; $12,607; $9,607; $3,607

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts