Question: please explain how to get social security tax please etc. Kathy Burnett works for Triumph Industries. Her pay rate is $12.30 per hour and she

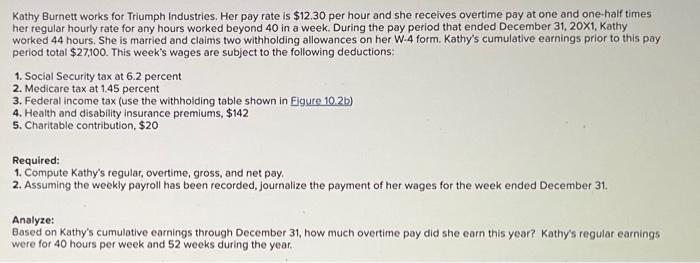

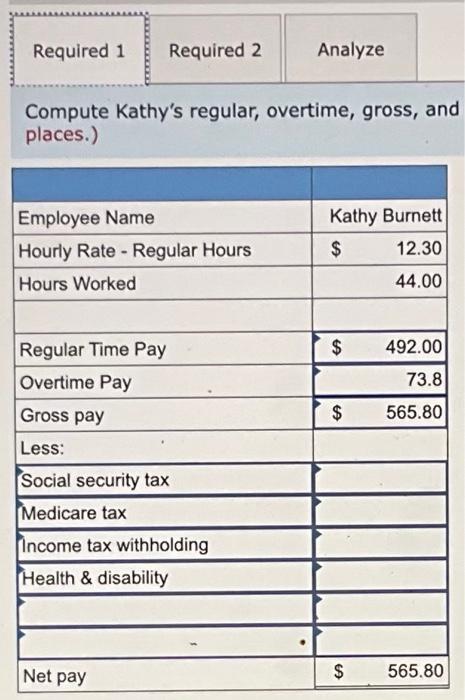

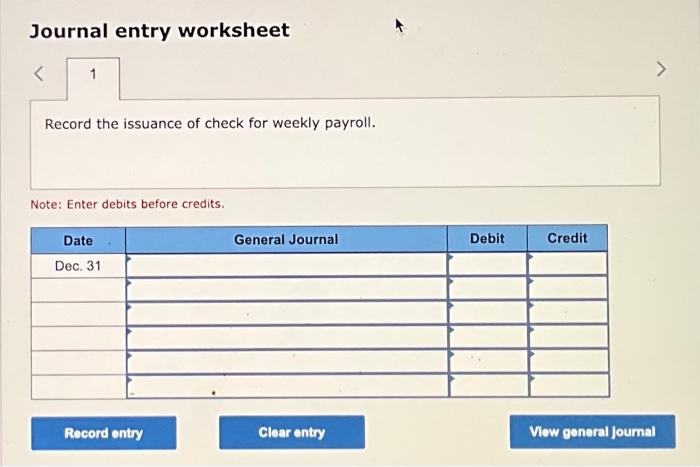

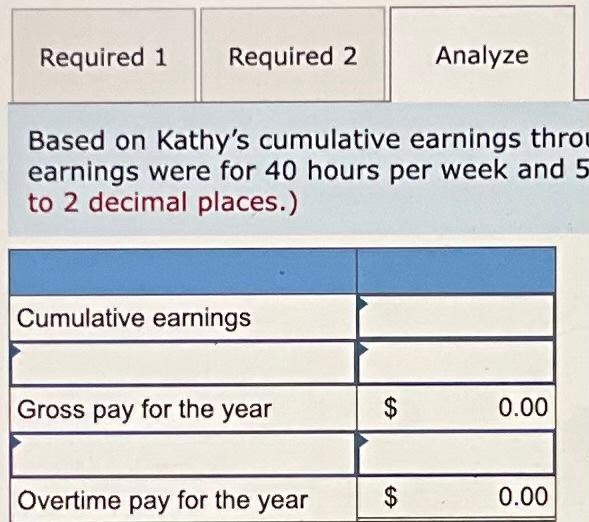

Kathy Burnett works for Triumph Industries. Her pay rate is $12.30 per hour and she receives overtime pay at one and one-half times her regular hourly rate for any hours worked beyond 40 in a week. During the pay period that ended December 31,201, Kathy worked 44 hours. She is married and claims two withholding allowances on her W-4 form. Kathy's cumulative earnings prior to this pay period total $27,100. This week's wages are subject to the following deductions: 1. Social Security tax at 6.2 percent 2. Medicare tax at 1.45 percent 3. Federal income tax (use the withholding table shown in Eigure 10.2b) 4. Health and disability insurance premiums, $142 5. Charitable contribution, $20 Required: 1. Compute Kathy's regular, overtime, gross, and net pay, 2. Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31. Analyze: Based on Kathy's cumulative earnings through December 31, how much overtime pay did she earn this year? Kathy's regular earnings were for 40 hours per week and 52 weeks during the year. Compute Kathy's regular, overtime, gross, and places.) Journal entry worksheet Record the issuance of check for weekly payroll. Note: Enter debits before credits. Based on Kathy's cumulative earnings thro earnings were for 40 hours per week and to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts