Question: Please explain how to get the answer by hand and/or using a financial calculator. Consider a sample of year-end prices for Alphabet, Inc. (Google) over

Please explain how to get the answer by hand and/or using a financial calculator.

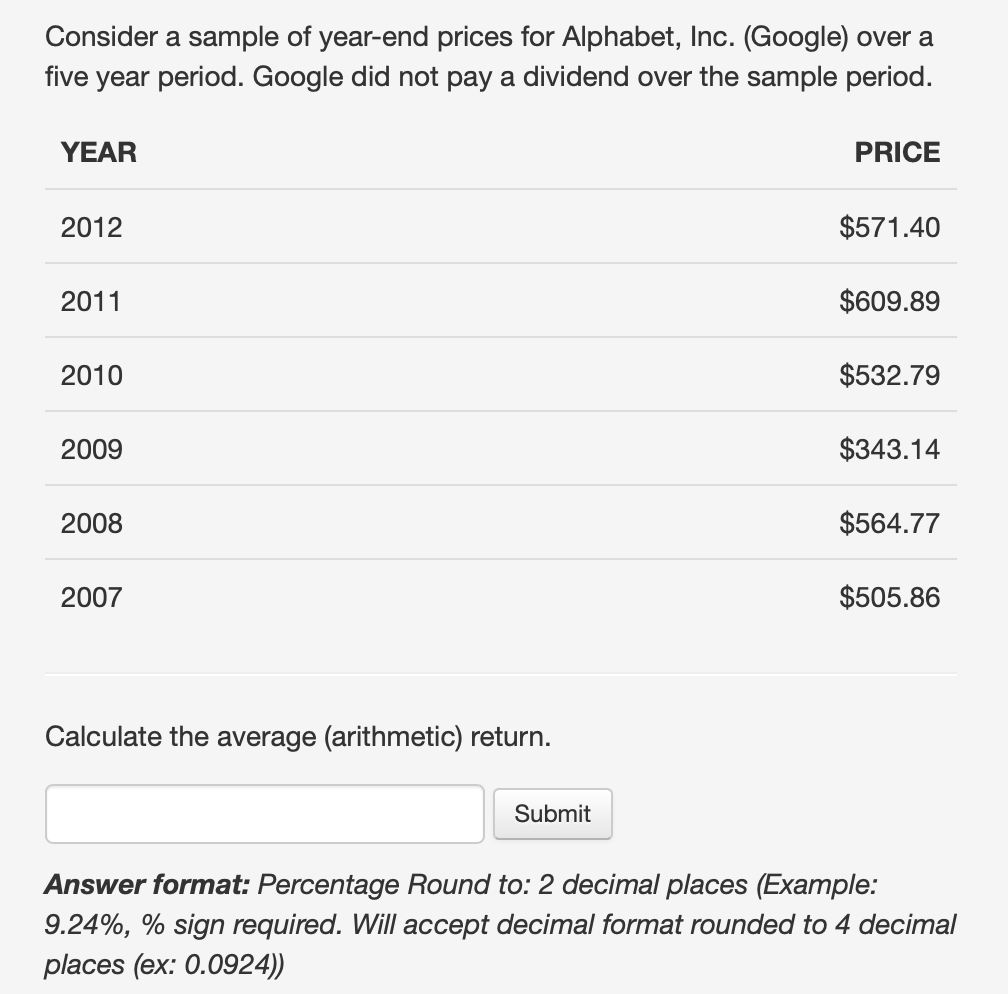

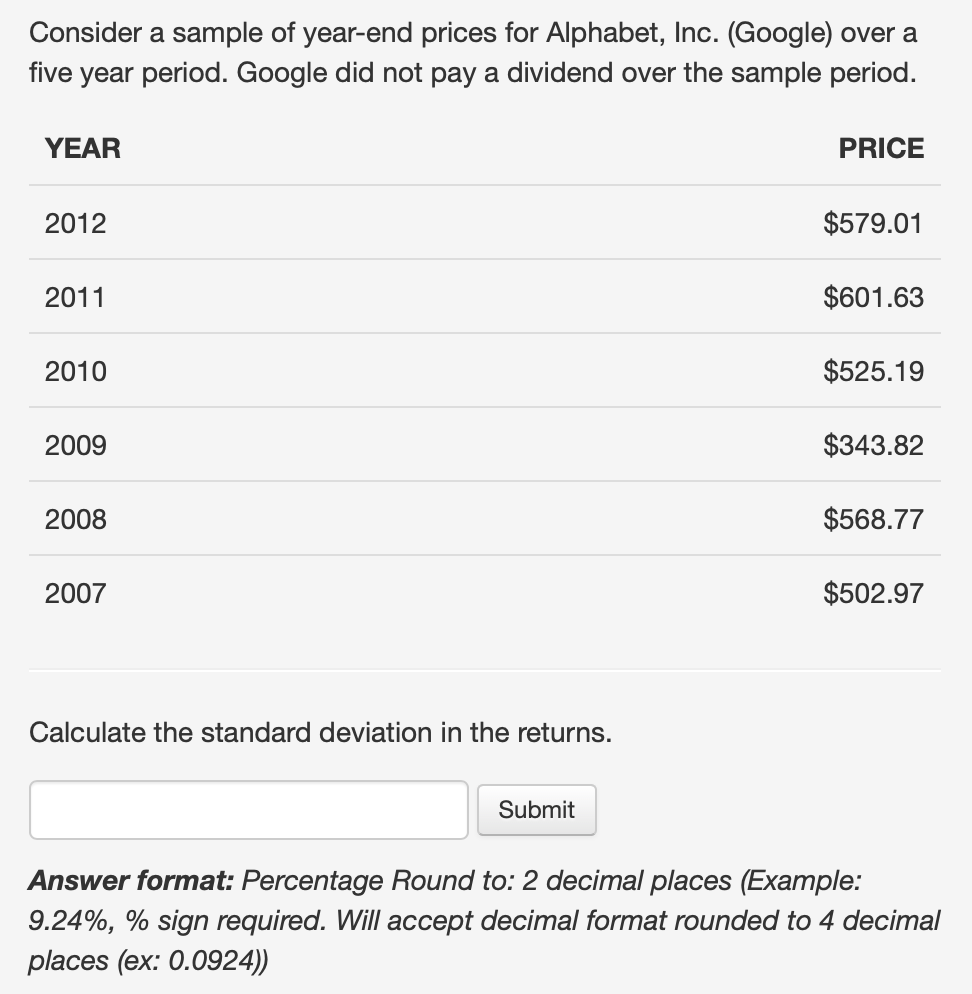

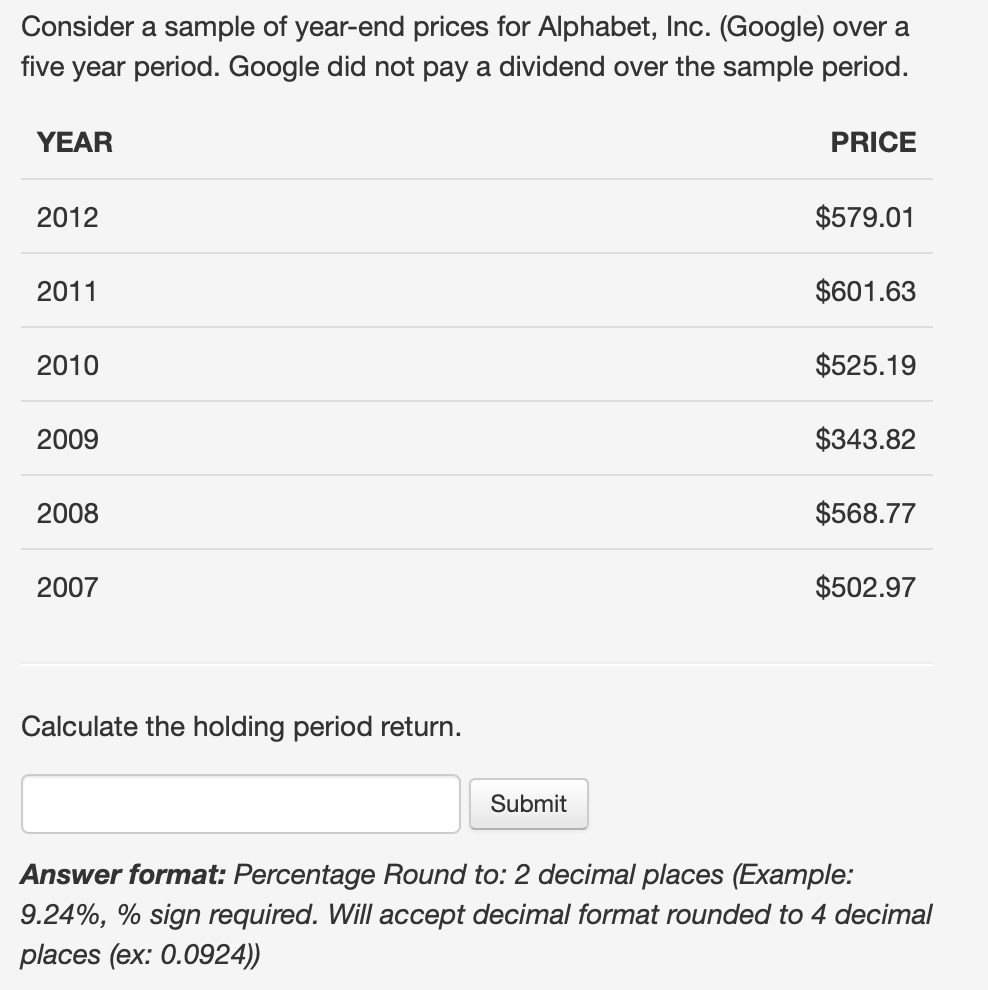

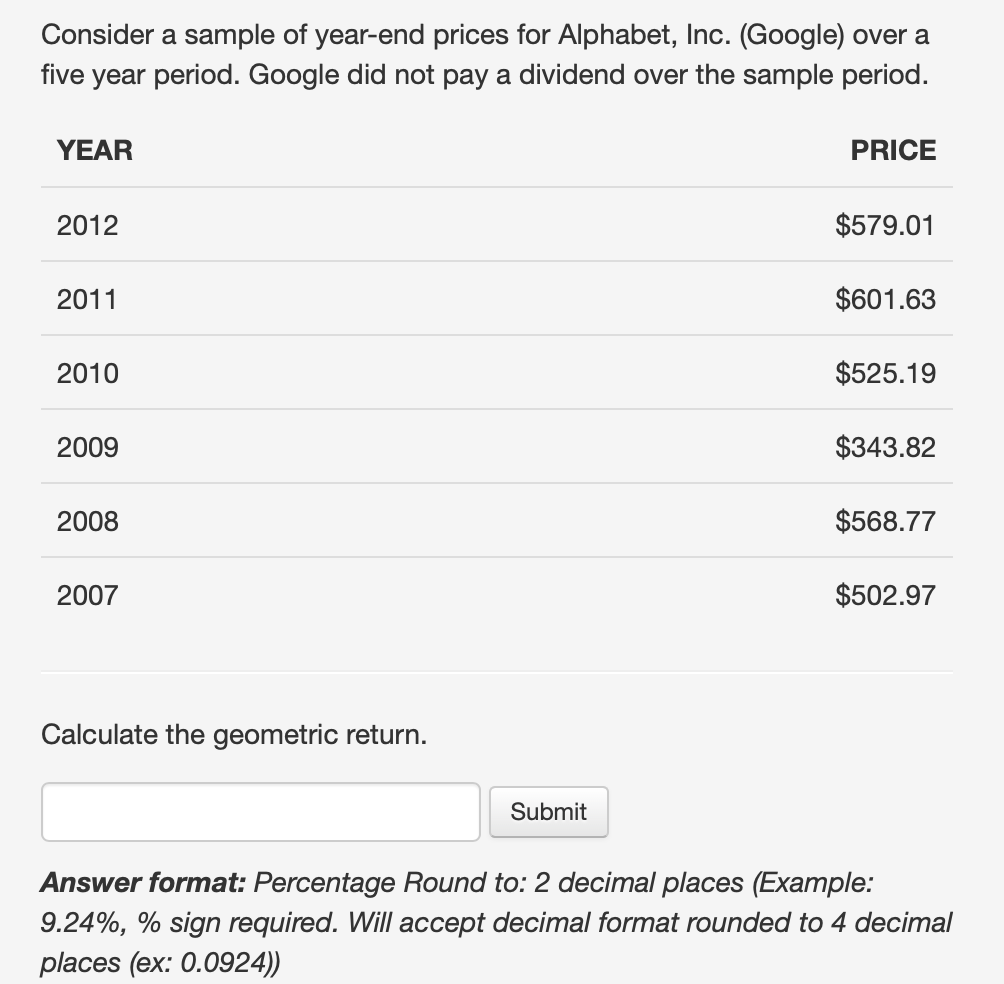

Consider a sample of year-end prices for Alphabet, Inc. (Google) over a five year period. Google did not pay a dividend over the sample period. YEAR PRICE 2012 $571.40 2011 $609.89 2010 $532.79 2009 $343.14 2008 $564.77 2007 $505.86 Calculate the average (arithmetic) return. Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Consider a sample of year-end prices for Alphabet, Inc. (Google) over a five year period. Google did not pay a dividend over the sample period. YEAR PRICE 2012 $579.01 2011 $601.63 2010 $525.19 2009 $343.82 2008 $568.77 2007 $502.97 Calculate the standard deviation in the returns. Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924) Consider a sample of year-end prices for Alphabet, Inc. (Google) over a five year period. Google did not pay a dividend over the sample period. YEAR PRICE 2012 $579.01 2011 $601.63 2010 $525.19 2009 $343.82 2008 $568.77 2007 $502.97 Calculate the holding period return. Submit Answer format: Percentage Round 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Consider a sample of year-end prices for Alphabet, Inc. (Google) over a five year period. Google did not pay a dividend over the sample period. YEAR PRICE 2012 $579.01 2011 $601.63 2010 $525.19 2009 $343.82 2008 $568.77 2007 $502.97 Calculate the geometric return. Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts