Question: Please explain how to put this on schedule c and if it goes on any other forms forms needed all together: 1040, S1, S2, S3,

Please explain how to put this on schedule c and if it goes on any other forms

forms needed all together: 1040, S1, S2, S3, Sa, Sb, Sc, Sd, Se, Sse, 4562, 8283, 8582, 8863, 8949, 8995

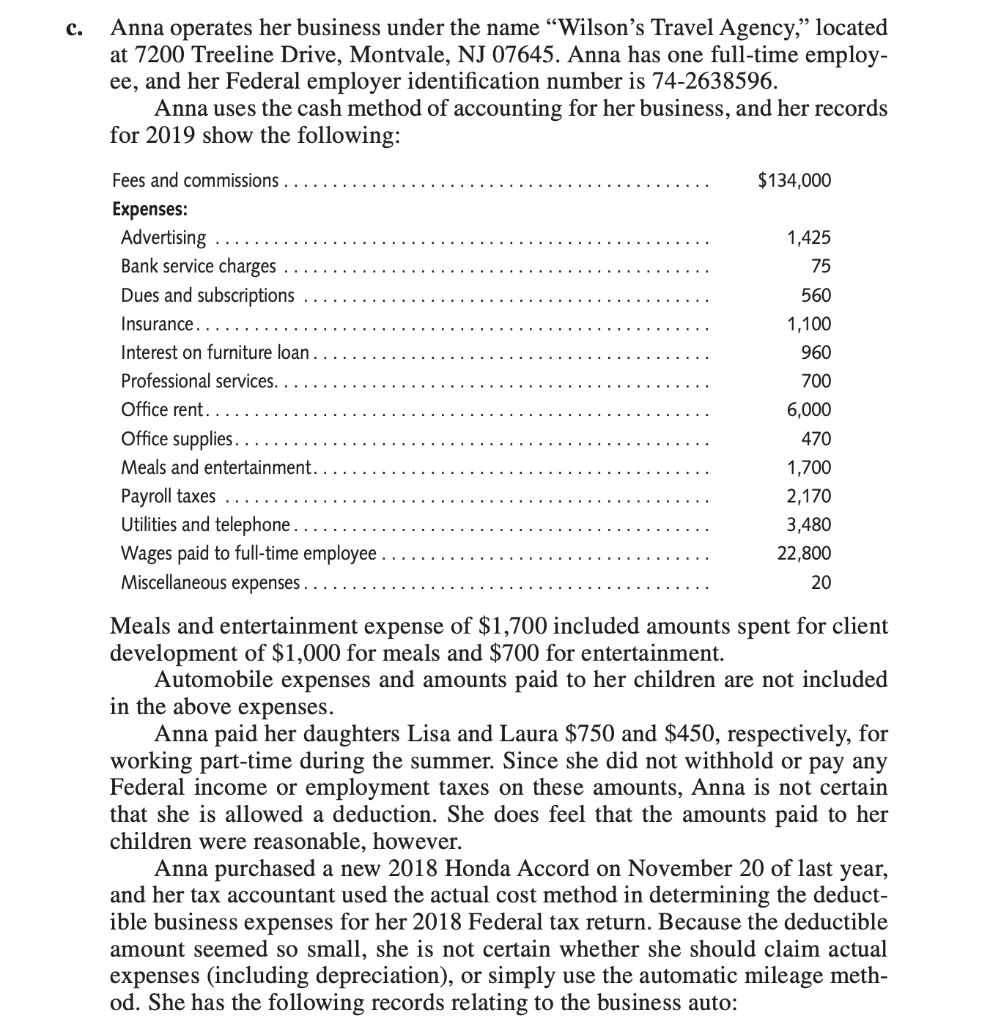

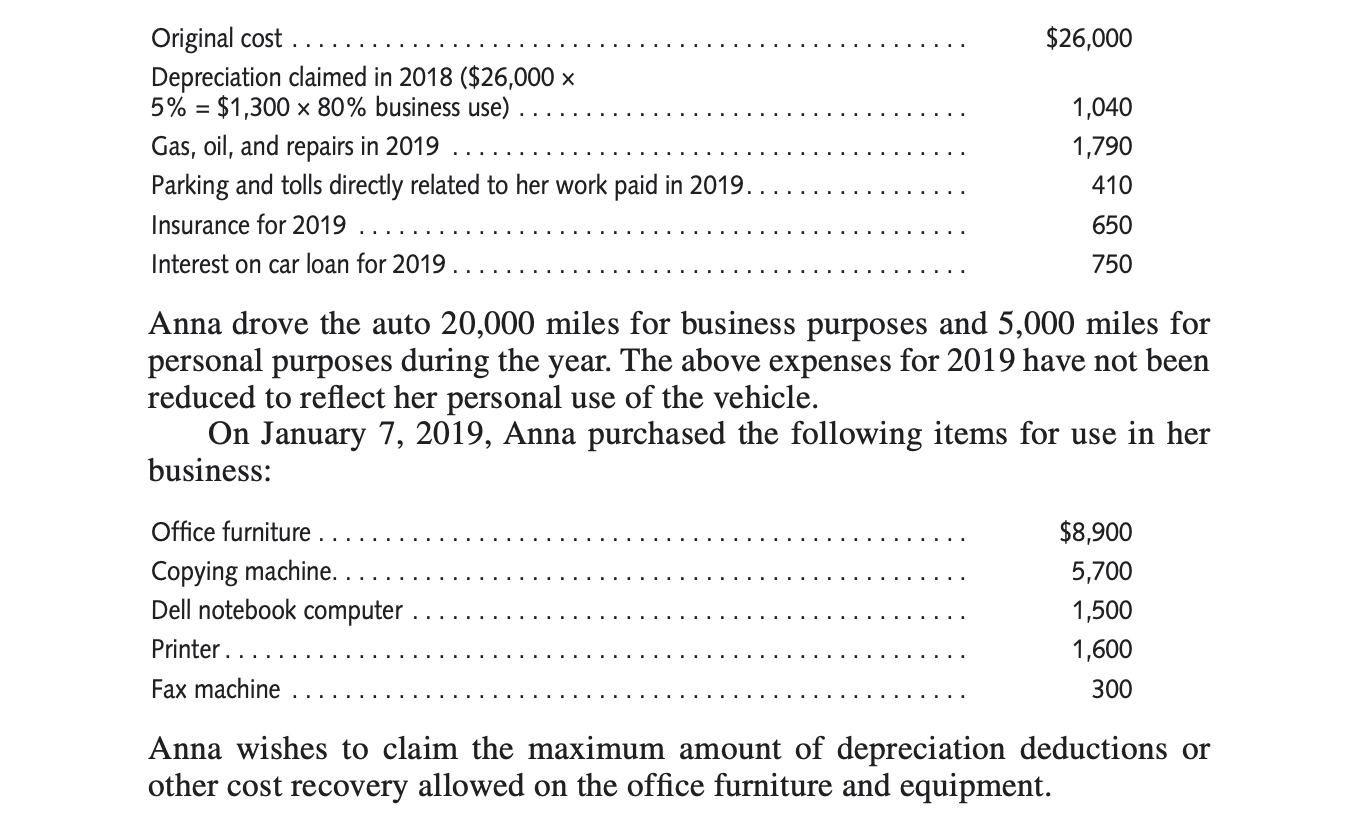

c. Anna operates her business under the name Wilson's Travel Agency, located at 7200 Treeline Drive, Montvale, NJ 07645. Anna has one full-time employ- ee, and her Federal employer identification number is 74-2638596. Anna uses the cash method of accounting for her business, and her records for 2019 show the following: $134,000 1,425 75 560 Fees and commissions. Expenses: Advertising Bank service charges Dues and subscriptions Insurance... Interest on furniture loan Professional services. Office rent.. Office supplies. Meals and entertainment.. Payroll taxes Utilities and telephone. Wages paid to full-time employee Miscellaneous expenses 1,100 960 700 6,000 470 1,700 2,170 3,480 22,800 20 Meals and entertainment expense of $1,700 included amounts spent for client development of $1,000 for meals and $700 for entertainment. Automobile expenses and amounts paid to her children are not included in the above expenses. Anna paid her daughters Lisa and Laura $750 and $450, respectively, for working part-time during the summer. Since she did not withhold or pay any Federal income or employment taxes on these amounts, Anna is not certain that she is allowed a deduction. She does feel that the amounts paid to her children were reasonable, however. Anna purchased a new 2018 Honda Accord on November 20 of last year, and her tax accountant used the actual cost method in determining the deduct- ible business expenses for her 2018 Federal tax return. Because the deductible amount seemed so small, she is not certain whether she should claim actual expenses (including depreciation), or simply use the automatic mileage meth- od. She has the following records relating to the business auto: $26,000 Original cost Depreciation claimed in 2018 ($26,000 x 5% = $1,300 x 80% business use) Gas, oil, and repairs in 2019 Parking and tolls directly related to her work paid in 2019. Insurance for 2019 Interest on car loan for 2019. 1,040 1,790 410 650 750 Anna drove the auto 20,000 miles for business purposes and 5,000 miles for personal purposes during the year. The above expenses for 2019 have not been reduced to reflect her personal use of the vehicle. On January 7, 2019, Anna purchased the following items for use in her business: Office furniture. Copying machine. Dell notebook computer Printer Fax machine $8,900 5,700 1,500 1,600 300 Anna wishes to claim the maximum amount of depreciation deductions or other cost recovery allowed on the office furniture and equipment. c. Anna operates her business under the name Wilson's Travel Agency, located at 7200 Treeline Drive, Montvale, NJ 07645. Anna has one full-time employ- ee, and her Federal employer identification number is 74-2638596. Anna uses the cash method of accounting for her business, and her records for 2019 show the following: $134,000 1,425 75 560 Fees and commissions. Expenses: Advertising Bank service charges Dues and subscriptions Insurance... Interest on furniture loan Professional services. Office rent.. Office supplies. Meals and entertainment.. Payroll taxes Utilities and telephone. Wages paid to full-time employee Miscellaneous expenses 1,100 960 700 6,000 470 1,700 2,170 3,480 22,800 20 Meals and entertainment expense of $1,700 included amounts spent for client development of $1,000 for meals and $700 for entertainment. Automobile expenses and amounts paid to her children are not included in the above expenses. Anna paid her daughters Lisa and Laura $750 and $450, respectively, for working part-time during the summer. Since she did not withhold or pay any Federal income or employment taxes on these amounts, Anna is not certain that she is allowed a deduction. She does feel that the amounts paid to her children were reasonable, however. Anna purchased a new 2018 Honda Accord on November 20 of last year, and her tax accountant used the actual cost method in determining the deduct- ible business expenses for her 2018 Federal tax return. Because the deductible amount seemed so small, she is not certain whether she should claim actual expenses (including depreciation), or simply use the automatic mileage meth- od. She has the following records relating to the business auto: $26,000 Original cost Depreciation claimed in 2018 ($26,000 x 5% = $1,300 x 80% business use) Gas, oil, and repairs in 2019 Parking and tolls directly related to her work paid in 2019. Insurance for 2019 Interest on car loan for 2019. 1,040 1,790 410 650 750 Anna drove the auto 20,000 miles for business purposes and 5,000 miles for personal purposes during the year. The above expenses for 2019 have not been reduced to reflect her personal use of the vehicle. On January 7, 2019, Anna purchased the following items for use in her business: Office furniture. Copying machine. Dell notebook computer Printer Fax machine $8,900 5,700 1,500 1,600 300 Anna wishes to claim the maximum amount of depreciation deductions or other cost recovery allowed on the office furniture and equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts