Question: what form does this go on. forms needed all together: 1040, S1, S2, S3, Sa, Sb, Sc, Sd, Se, Sse, 4562, 8283, 8582, 8863, 8949,

what form does this go on.

forms needed all together: 1040, S1, S2, S3, Sa, Sb, Sc, Sd, Se, Sse, 4562, 8283, 8582, 8863, 8949, 8995

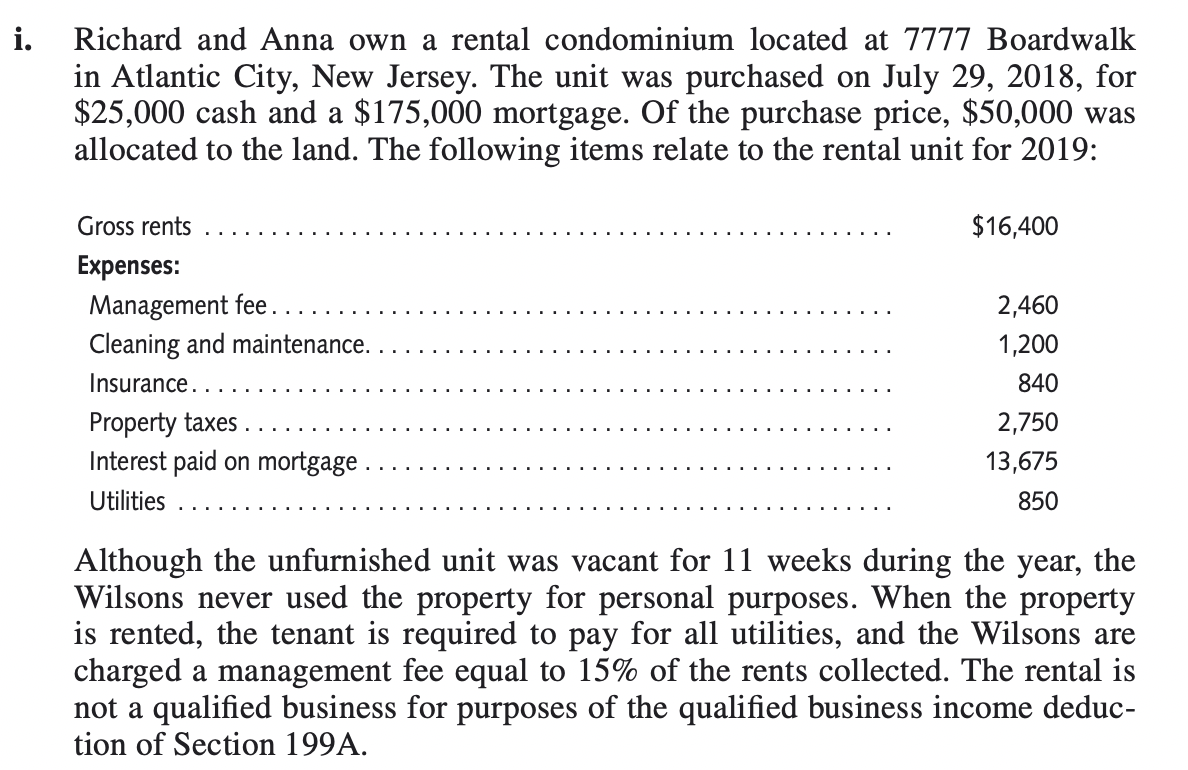

i. Richard and Anna own a rental condominium located at 7777 Boardwalk in Atlantic City, New Jersey. The unit was purchased on July 29, 2018, for $25,000 cash and a $175,000 mortgage. Of the purchase price, $50,000 was allocated to the land. The following items relate to the rental unit for 2019: $16,400 Gross rents Expenses: Management fee Cleaning and maintenance. Insurance. Property taxes Interest paid on mortgage Utilities 2,460 1,200 840 2,750 13,675 850 Although the unfurnished unit was vacant for 11 weeks during the year, the Wilsons never used the property for personal purposes. When the property is rented, the tenant is required to pay for all utilities, and the Wilsons are charged a management fee equal to 15% of the rents collected. The rental is not a qualified business for purposes of the qualified business income deduc- tion of Section 199A. i. Richard and Anna own a rental condominium located at 7777 Boardwalk in Atlantic City, New Jersey. The unit was purchased on July 29, 2018, for $25,000 cash and a $175,000 mortgage. Of the purchase price, $50,000 was allocated to the land. The following items relate to the rental unit for 2019: $16,400 Gross rents Expenses: Management fee Cleaning and maintenance. Insurance. Property taxes Interest paid on mortgage Utilities 2,460 1,200 840 2,750 13,675 850 Although the unfurnished unit was vacant for 11 weeks during the year, the Wilsons never used the property for personal purposes. When the property is rented, the tenant is required to pay for all utilities, and the Wilsons are charged a management fee equal to 15% of the rents collected. The rental is not a qualified business for purposes of the qualified business income deduc- tion of Section 199A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts