Question: Please explain how to solve and how to imput equation on financial calculator: Splash Bottling's December 31st balance sheet is given below: Sales during the

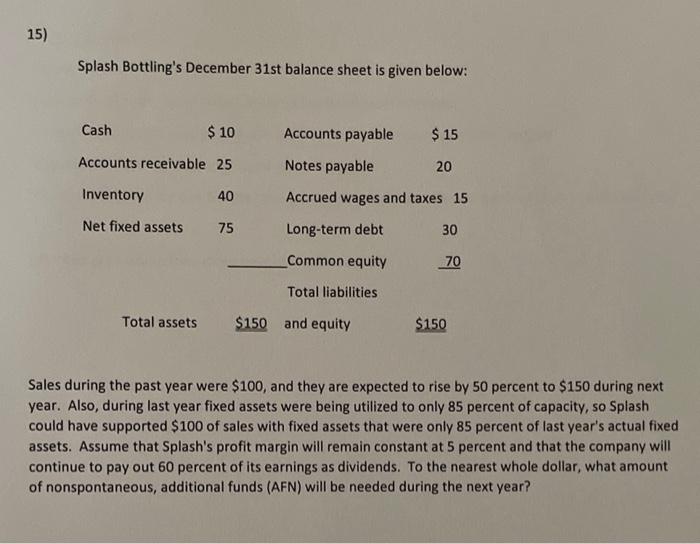

Splash Bottling's December 31st balance sheet is given below: Sales during the past year were $100, and they are expected to rise by 50 percent to $150 during next year. Also, during last year fixed assets were being utilized to only 85 percent of capacity, so Splash could have supported $100 of sales with fixed assets that were only 85 percent of last year's actual fixed assets. Assume that Splash's profit margin will remain constant at 5 percent and that the company will continue to pay out 60 percent of its earnings as dividends. To the nearest whole dollar, what amount of nonspontaneous, additional funds (AFN) will be needed during the next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts