Question: Please explain how to solve b and c part. Thank you!! OA-14 Date: Sat, Apr 9, 2022, 04:00 PM Check My Answer Question 6 of

Please explain how to solve b and c part.

Thank you!!

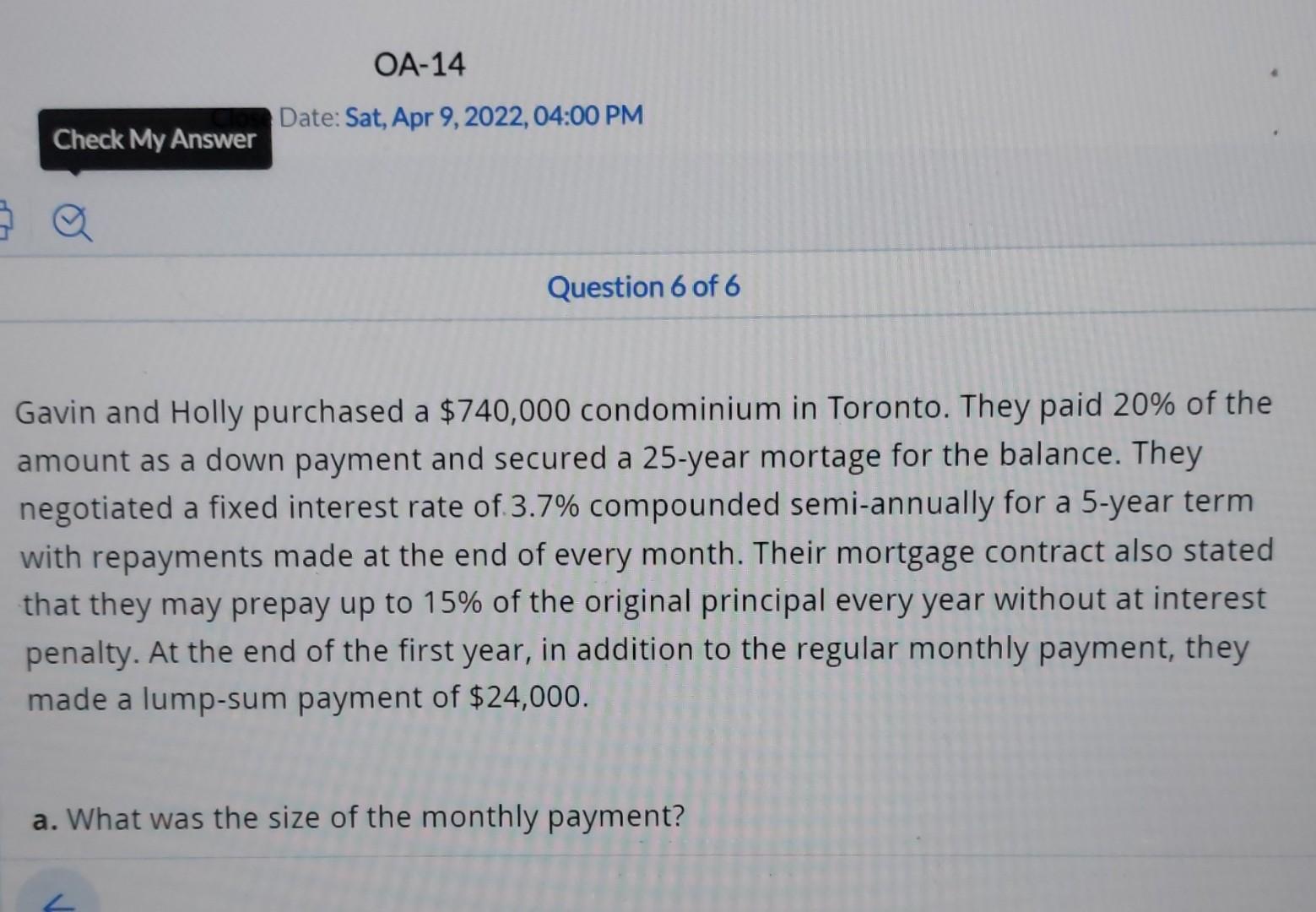

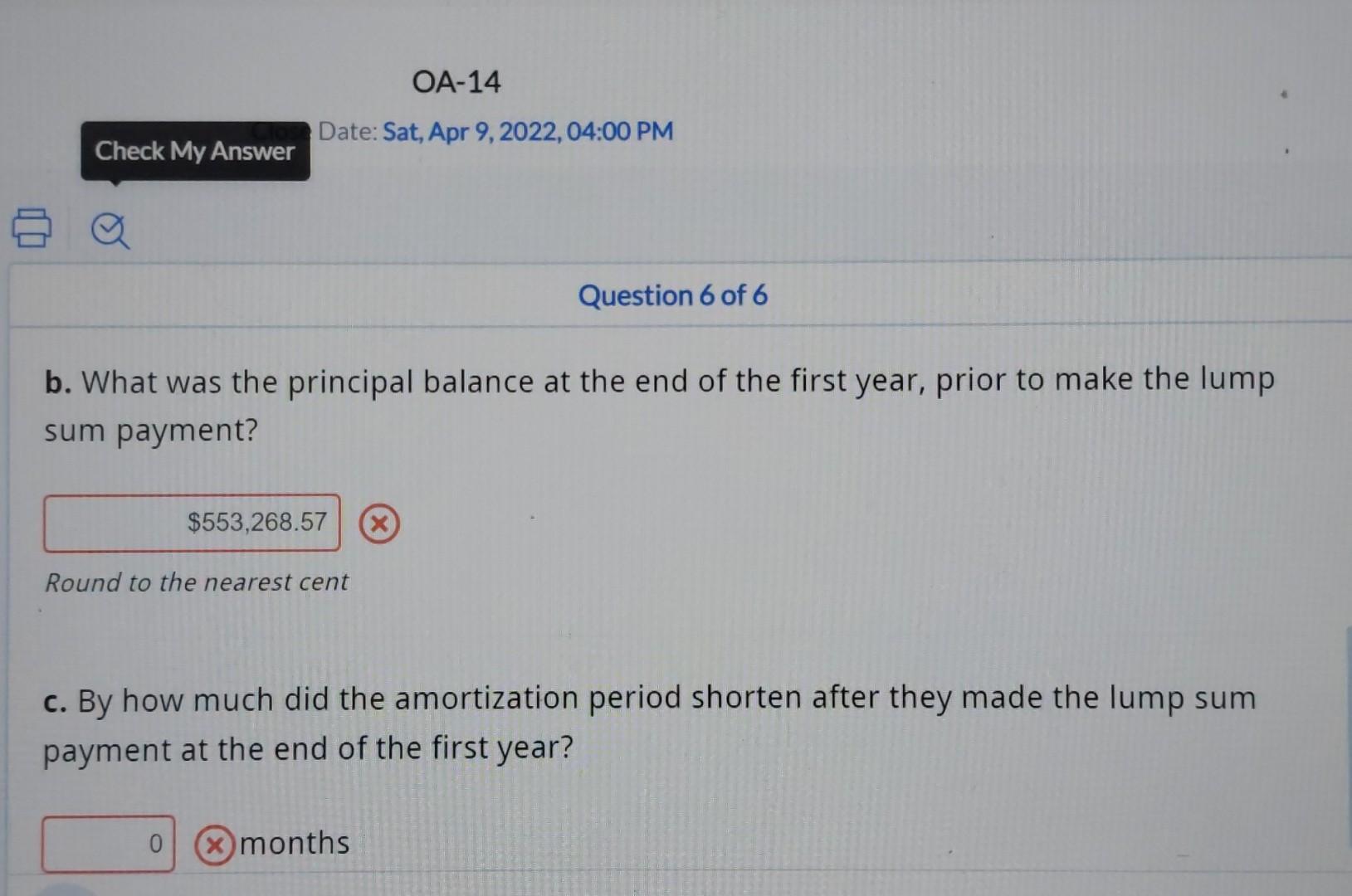

OA-14 Date: Sat, Apr 9, 2022, 04:00 PM Check My Answer Question 6 of 6 Gavin and Holly purchased a $740,000 condominium in Toronto. They paid 20% of the amount as a down payment and secured a 25-year mortage for the balance. They negotiated a fixed interest rate of 3.7% compounded semi-annually for a 5-year term with repayments made at the end of every month. Their mortgage contract also stated that they may prepay up to 15% of the original principal every year without at interest penalty. At the end of the first year, in addition to the regular monthly payment, they made a lump-sum payment of $24,000. a. What was the size of the monthly payment? OA-14 Date: Sat, Apr 9, 2022, 04:00 PM Check My Answer Question 6 of 6 b. What was the principal balance at the end of the first year, prior to make the lump sum payment? $553,268.57 x Round to the nearest cent c. By how much did the amortization period shorten after they made the lump sum payment at the end of the first year? 0 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts