Question: please explain how to solve question 7 preferably in excel or simple handwritten thank you! Question 6 0/1 pts Please note that the following data

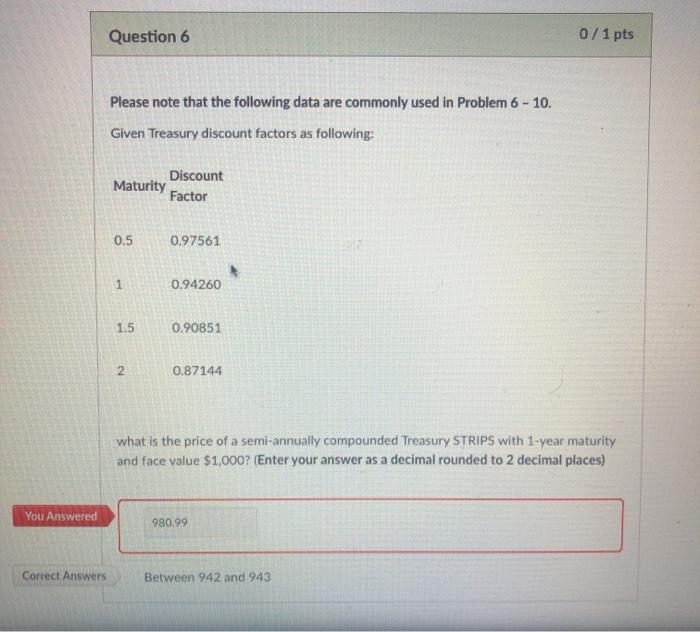

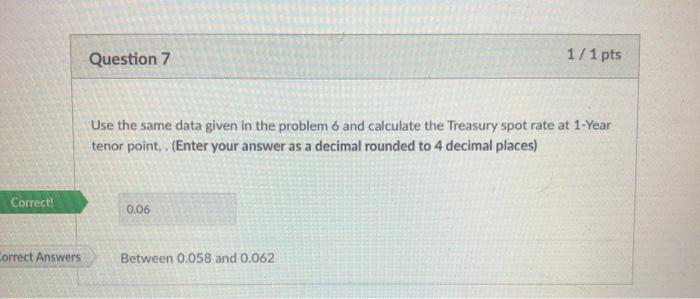

Question 6 0/1 pts Please note that the following data are commonly used in Problem 6 - 10. Given Treasury discount factors as following: Maturity Factor Discount 0.5 0.97561 + 1 0.94260 1.5 0.90851 2 0.87144 what is the price of a semi-annually compounded Treasury STRIPS with 1-year maturity and face value $1,000? (Enter your answer as a decimal rounded to 2 decimal places) You Answered 980.99 Correct Answers Between 942 and 943 Question 7 1/1 pts Use the same data given in the problem 6 and calculate the Treasury spot rate at 1-Year tenor point (Enter your answer as a decimal rounded to 4 decimal places) Correct! 0.06 orrect Answers Between 0.058 and 0.062

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts