Question: Please explain how you calculate the values For the given income statement, retained earning statement, and balance sheets, calculate the sources/uses of funds and fill

Please explain how you calculate the values

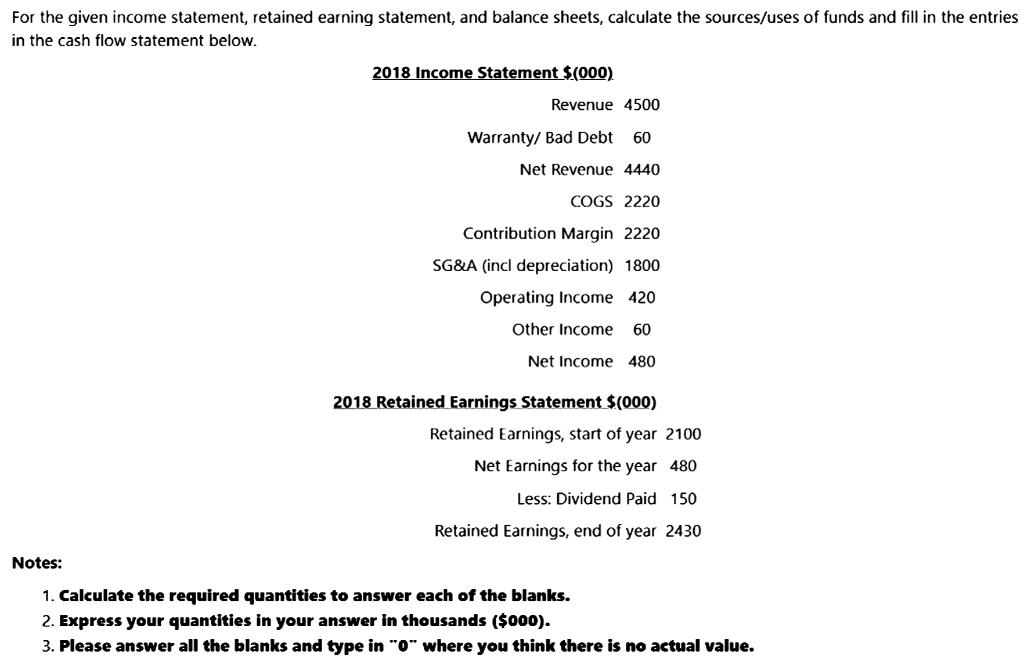

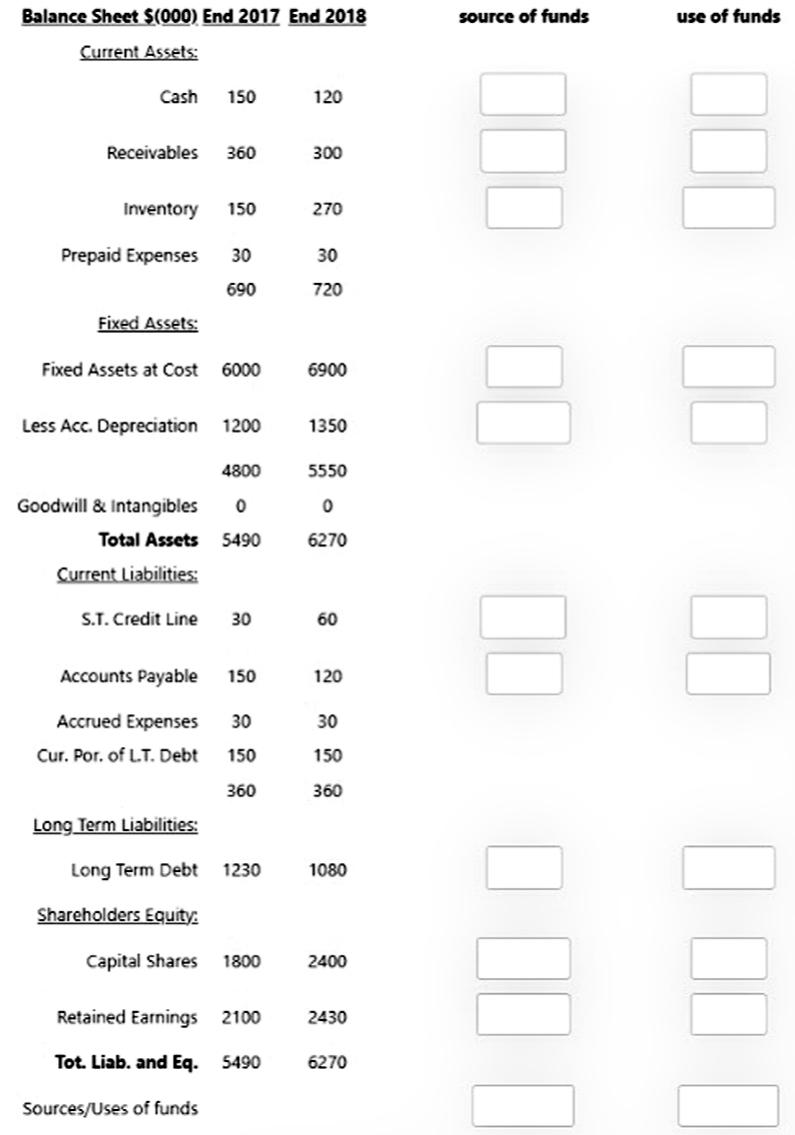

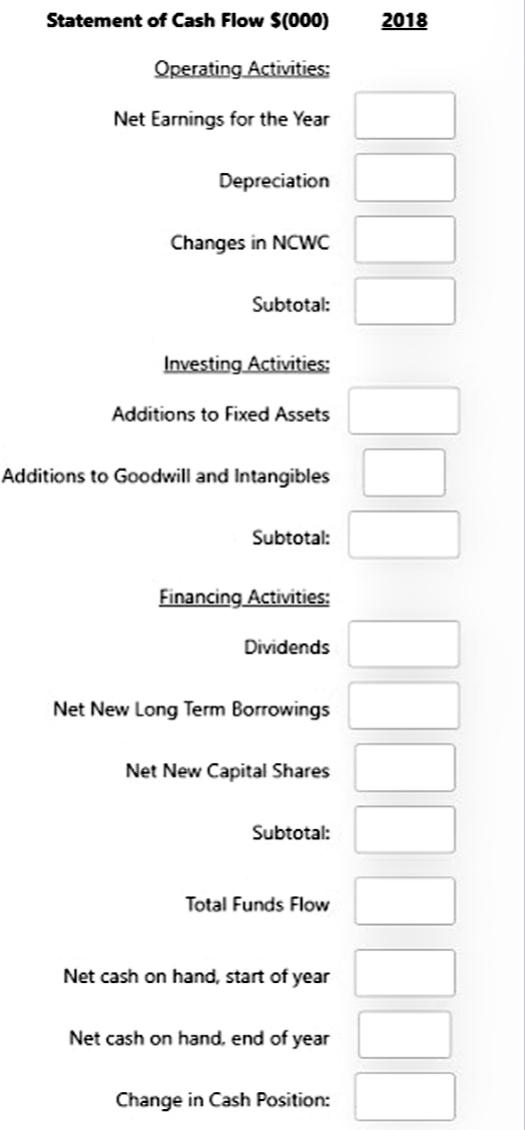

For the given income statement, retained earning statement, and balance sheets, calculate the sources/uses of funds and fill in the entries in the cash flow statement below. 2018 Income Statement $(000). Revenue 4500 Warranty/ Bad Debt 60 Net Revenue 4440 COGS 2220 Contribution Margin 2220 SG&A (incl depreciation) 1800 Operating Income 420 Other Income 60 Net Income 480 2018 Retained Earnings Statement $(000) Retained Earnings, start of year 2100 Net Earnings for the year 480 Less: Dividend Paid 150 Retained Earnings, end of year 2430 Notes: 1. Calculate the required quantities to answer each of the blanks. 2. Express your quantities in your answer in thousands ($000). 3. Please answer all the blanks and type in "0" where you think there is no actual value. Balance Sheet $(000) End 2017 End 2018 source of funds use of funds Current Assets: Cash 150 120 Receivables 360 300 Inventory 150 270 Prepaid Expenses 30 30 690 720 Fixed Assets: Fixed Assets at Cost 6000 6900 Less Acc. Depreciation 1200 1350 4800 5550 0 o Goodwill & Intangibles Total Assets 5490 6270 Current liabilities: S.T. Credit Line 30 60 II Accounts Payable 150 120 Accrued Expenses 30 30 Cur. Por. of L.T. Debt 150 150 360 360 Long Term Liabilities: Long Term Debt 1230 1080 Shareholders Equity: Capital Shares 1800 2400 Retained Earnings 2100 2430 Tot. Liab. and Eq. 5490 6270 Sources/Uses of funds Statement of Cash Flow $(000) 2018 Operating Activities: Net Earnings for the Year Depreciation Changes in NCWC Subtotal: Investing Activities: Additions to Fixed Assets Additions to Goodwill and Intangibles Subtotal: Financing Activities: Dividends Net New Long Term Borrowings Net New Capital Shares Subtotal: Total Funds Flow Net cash on hand, start of year Net cash on hand, end of year Change in Cash Position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts