Question: please explain how you did it with formulas. thank you! Timmy Tappan is single and had $189,000 in taxable income. Using the rates from Table

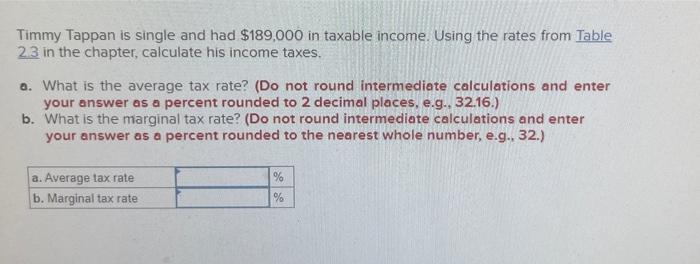

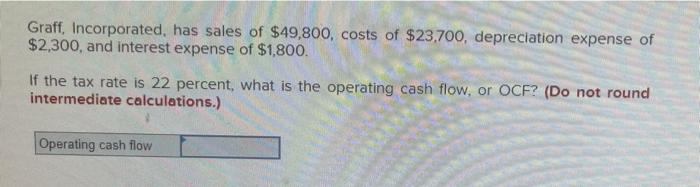

Timmy Tappan is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate his income taxes. a. What is the average tax rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the marginal tax rate? (Do not round intermediate calculations and enter your answer as a percent rounded to the nearest whole number, e.g., 32.) a. Average tax rate b. Marginal tax rate go do % % Graff, Incorporated, has sales of $49,800, costs of $23,700, depreciation expense of $2,300, and interest expense of $1,800. If the tax rate is 22 percent, what is the operating cash flow, or OCF? (Do not round intermediate calculations.) Operating cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts