Question: Please explain how you get to your answer I had to reset because I kept getting it wrong. Entries for Investment in Bonds, Interest, and

Please explain how you get to your answer I had to reset because I kept getting it wrong.

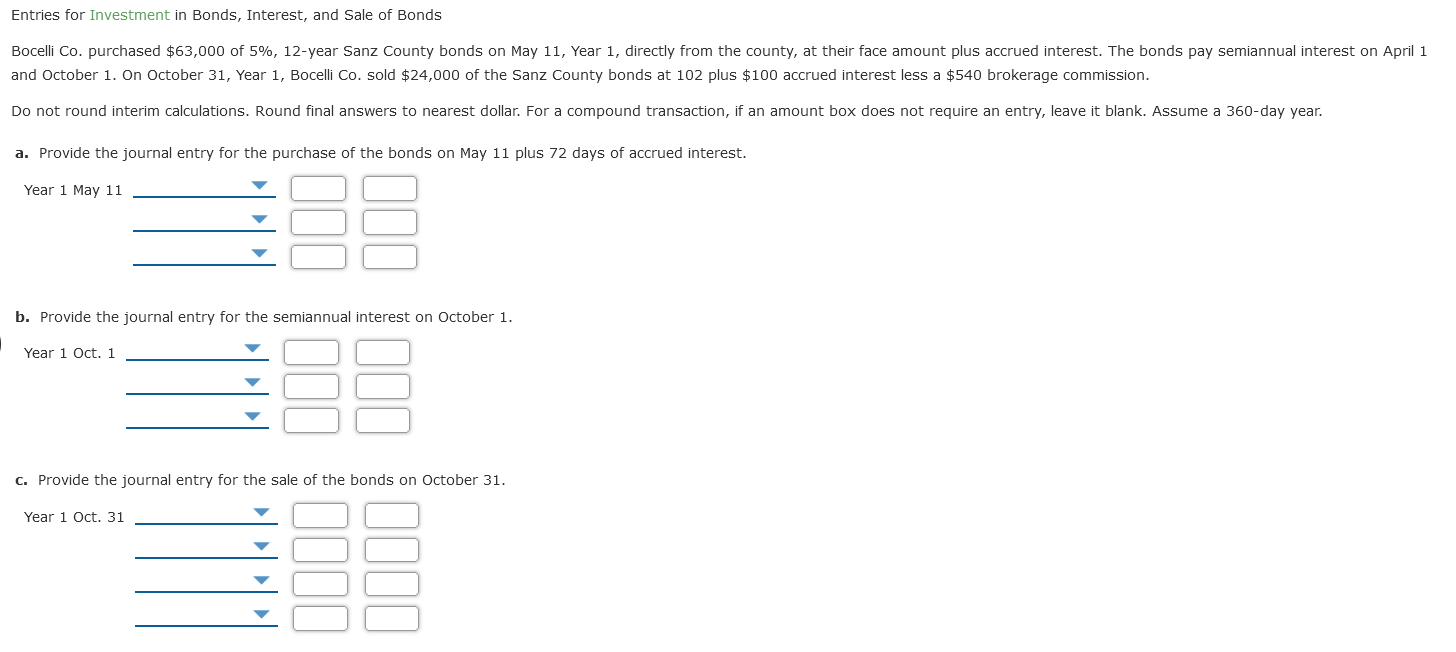

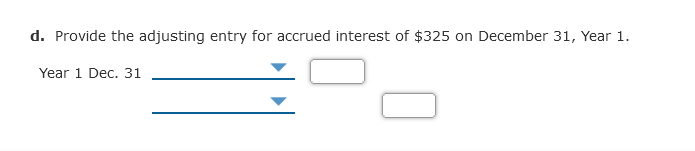

Entries for Investment in Bonds, Interest, and Sale of Bonds Bocelli Co. purchased $63,000 of 5%, 12-year Sanz County bonds on May 11, Year 1, directly from the county, at their face amount plus accrued interest. The bonds pay semiannual interest on April 1 and October 1. On October 31, Year 1, Bocelli Co. sold $24,000 of the Sanz County bonds at 102 plus $100 accrued interest less a $540 brokerage commission. Do not round interim calculations. Round final answers to nearest dollar. For a compound transaction, if an amount box does not require an entry, leave it blank. Assume a 360-day year. a. Provide the journal entry for the purchase of the bonds on May 11 plus 72 days of accrued interest. Year 1 May 11 b. Provide the journal entry for the semiannual interest on October 1. Year 1 Oct. 1 C. Provide the journal entry for the sale of the bonds on October 31. Year 1 Oct. 31 III LIII d. Provide the adjusting entry for accrued interest of $325 on December 31, Year 1. Year 1 Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts