Question: Please explain how you go about drawing the graph. Its very confusing aha. I found a textbook solution on here too but i didnt understand

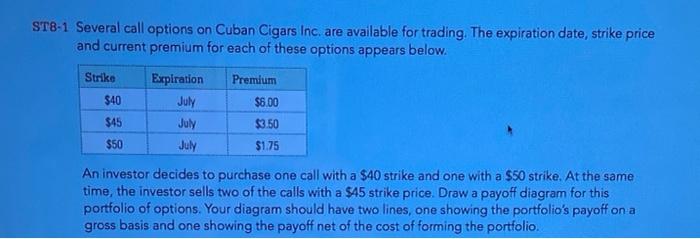

ST8-1 Several call options on Cuban Cigars Inc. are available for trading. The expiration date, strike price and current premium for each of these options appears below. Strike Expiration Premium $40 July $6.00 $45 July $3.50 $50 July $1.75 An investor decides to purchase one call with a $40 strike and one with a $50 strike. At the same time, the investor sells two of the calls with a $45 strike price. Draw a payoff diagram for this portfolio of options. Your diagram should have two lines, one showing the portfolio's payoff on a gross basis and one showing the payoff net of the cost of forming the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts