Question: PLEASE Explain how you got the answers. Consider the case of the following annuities, and the need to compute either their expected rate of return

PLEASE Explain how you got the answers.

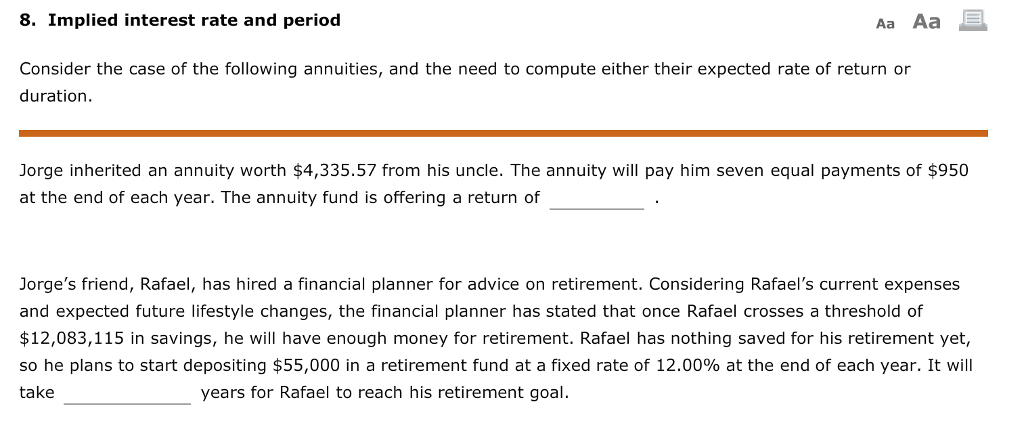

Consider the case of the following annuities, and the need to compute either their expected rate of return or duration. Jorge inherited an annuity worth $4, 335.57 from his uncle. The annuity will pay him seven equal payments of $950 at the end of each year. The annuity fund is offering a return of _.0 Jorge's friend, Rafael, has hired a financial planner for advice on retirement. Considering Rafael's current expenses and expected future lifestyle changes, the financial planner has stated that once Rafael crosses a threshold of $12, 083, 115 in savings, he will have enough money for retirement. Rafael has nothing saved for his retirement yet, so he plans to start depositing $55,000 in a retirement fund at a fixed rate of 12.00% at the end of each year. It will take _ years for Rafael to reach his retirement goal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts