Question: please help asap! Attempts Keep the Higheat /2 9. Implied interest rate and period Consider the case of the following annuities, and the need to

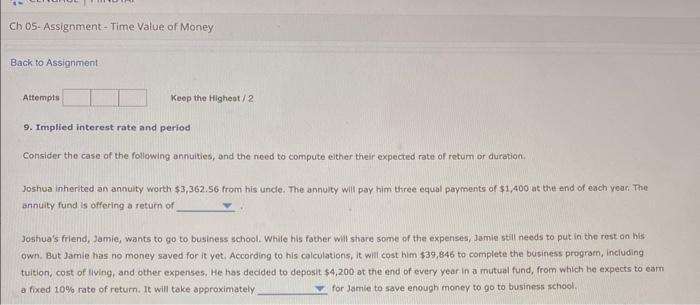

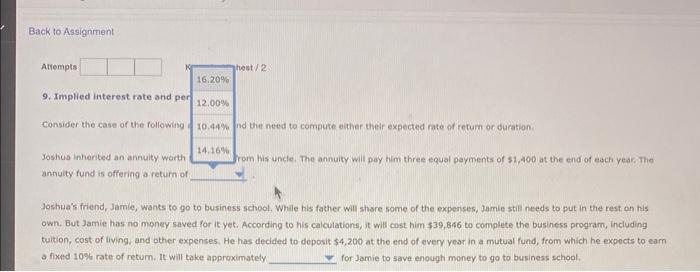

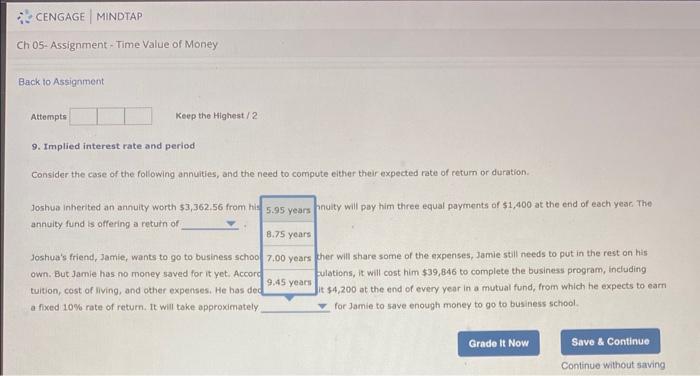

Attempts Keep the Higheat /2 9. Implied interest rate and period Consider the case of the following annuities, and the need to compute either their expected rate of retum or duration. Joshua inherited an annulty worth $3,362.56 from his uncle. The annuity will pay him three equal payments of $1,400 at the end of each year. The annuity fund is offering a return of Joshua's friend, Jamie, wants to go to business school. While his father will share some of the expenses, Jamie still needs to put in the rest on his own. But Jarnie has no money saved for it yet. According to his calculations, it will cost him $39,846 to complete the business program, inciuding tuition, cost of uving, and other expenses. He has decided to deposit $4,200 at the end of every year in a mutual fund, from which he expects to eam a foced 10% rate of return. It will take approximately for Jamie to save enough money to go to business school. Atiempts 9. Implied interest rate and per 4.00% annyity fund is offering a return of Joshua's friend, Jamie, wants to go to business school. While his father will share some of the expenses, Jamie still needs to put in the rest on his own. But Jamie has no money saved for it yet. According to his calculations, it will cost him $39, 846 to complete the business program, including tuition, cost of living, and other expenses, He has decided to deposit $4,200 at the end of every year in a mutual fund, from which he expects to earn a fixed 10%6 rate of return. It will take approximately for Jamie to save enough money to go to business school, 9. Implied interest rate and period Consider the case of the following annuities, and the need to compute either their expected rate of retum or duration. Joshua inherited an annuity worth $3,362.56 from hi. inulty will pay him three equal payments of $1,400 at the end of each yeac The annuity fund is offering a retuin of Joshua's friend, Jamie, wants to g0 to business schoc ther will share some of the expenses, Jamie still needs to put in the rest on his own. But Jamie has no money saved for it yet, Accon ulations, it will cost him $39,846 to complete the business program, including tuition, cost of living, and other expenses, He has de it $4,200 ot the end of every year in a mutual fund, from which he expects to earn a fixed 10% rate of return. It will take approximately for Jamie to save enough money to go to business school

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts