Question: please explain how you reached the adjusting entries Anderson's Accommodating Automobiles sells used cars. In order to incentivize sales, it orrers a 3 year warranty

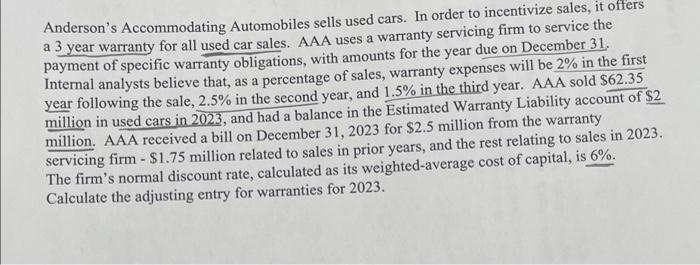

Anderson's Accommodating Automobiles sells used cars. In order to incentivize sales, it orrers a 3 year warranty for all used car sales. AAA uses a warranty servicing firm to service the payment of specific warranty obligations, with amounts for the year due on December 31 . Internal analysts believe that, as a percentage of sales, warranty expenses will be 2% in the first year following the sale, 2.5% in the second year, and 1.5% in the third year. AAA sold $62.35 million in used cars in 2023 , and had a balance in the Estimated Warranty Liability account of $2 million. AAA received a bill on December 31,2023 for $2.5 million from the warranty servicing firm - $1.75 million related to sales in prior years, and the rest relating to sales in 2023. The firm's normal discount rate, calculated as its weighted-average cost of capital, is 6%. Calculate the adjusting entry for warranties for 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts