Question: Please explain if necessary Sue has a small stall at a local market that runs every first Saturday of the month, selling dog shampoo. At

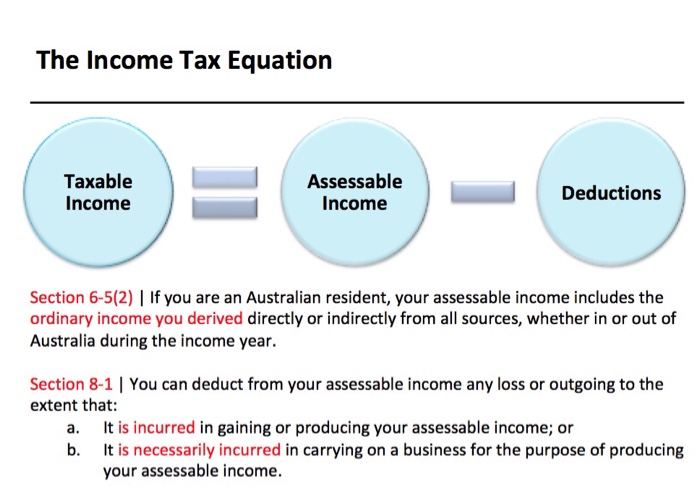

The Income Tax Equation Taxable Income Assessable Income Deductions Section 6-5(2) If you are an Australian resident, your assessable income includes the ordinary income you derived directly or indirectly from all sources, whether in or out of Australia during the income year Section 8-1 | You can deduct from your assessable income any loss or outgoing to the extent that: It is incurred in gaining or producing your assessable income; or It is necessarily incurred in carrying on a business for the purpose of producing your assessable income. a. b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts