Question: please explain in detail. thank you! 1. Computing and using the CM Ratio. Last month when Rodgers, Inc. sold 90,000 units, total sales wer $450,000,

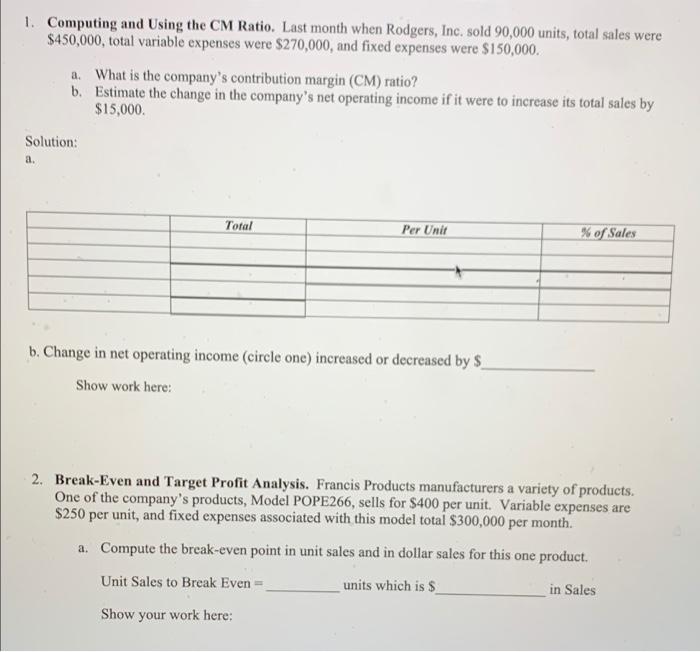

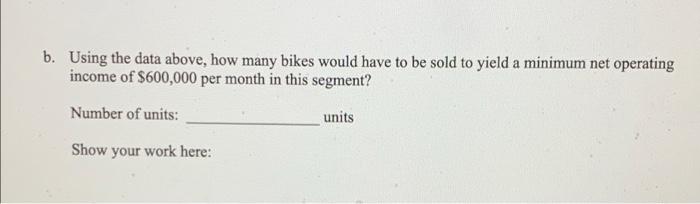

1. Computing and using the CM Ratio. Last month when Rodgers, Inc. sold 90,000 units, total sales wer $450,000, total variable expenses were $270,000, and fixed expenses were $150,000. a. What is the company's contribution margin (CM) ratio? b. Estimate the change in the company's net operating income if it were to increase its total sales by $15,000 Solution: a. Total Per Unit % of Sales b. Change in net operating income (circle one) increased or decreased by $ Show work here: 2. Break-Even and Target Profit Analysis. Francis Products manufacturers a variety of products. One of the company's products, Model POPE266, sells for $400 per unit. Variable expenses are $250 per unit, and fixed expenses associated with this model total $300,000 per month a. Compute the break-even point in unit sales and in dollar sales for this one product. Unit Sales to Break Even units which is $ in Sales Show your work here: b. Using the data above, how many bikes would have to be sold to yield a minimum net operating income of $600,000 per month in this segment? Number of units: units Show your work here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts