Question: Engineering Economic problem. Thanks for your reply. No excel form, please. A nationwide hotel chain is considering locating a new hotel in Bigtown, USA. The

Engineering Economic problem. Thanks for your reply. No excel form, please.

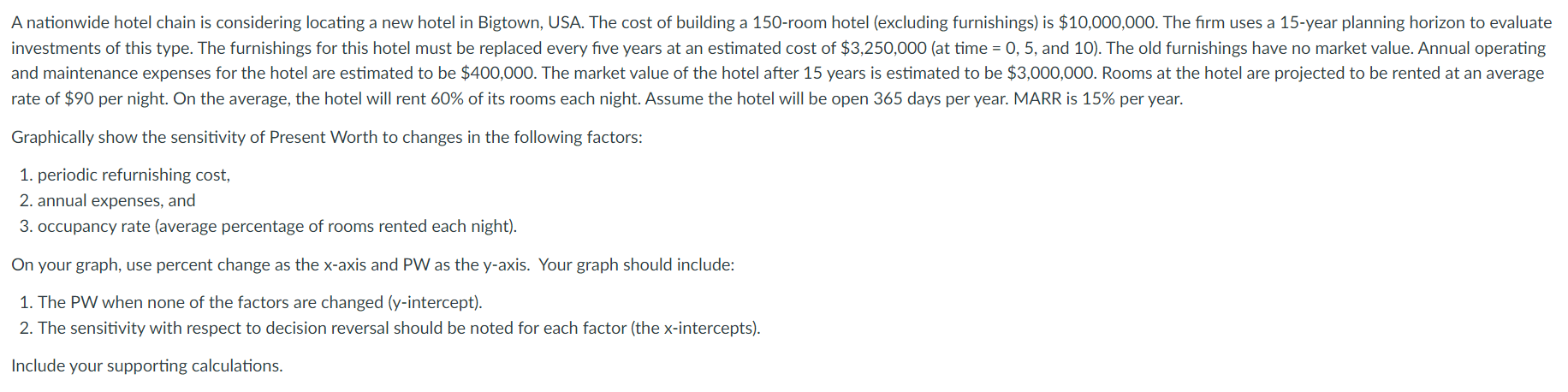

A nationwide hotel chain is considering locating a new hotel in Bigtown, USA. The cost of building a 150 -room hotel (excluding furnishings) is $10,000,000. The firm uses a 15 -year planning horizon to evaluate investments of this type. The furnishings for this hotel must be replaced every five years at an estimated cost of $3,250,000 (at time =0,5, and 10 ). The old furnishings have no market value. Annual operating and maintenance expenses for the hotel are estimated to be $400,000. The market value of the hotel after 15 years is estimated to be $3,000,000. Rooms at the hotel are projected to be rented at an average rate of $90 per night. On the average, the hotel will rent 60% of its rooms each night. Assume the hotel will be open 365 days per year. MARR is 15% per year. Graphically show the sensitivity of Present Worth to changes in the following factors: 1. periodic refurnishing cost, 2. annual expenses, and 3. occupancy rate (average percentage of rooms rented each night). On your graph, use percent change as the x-axis and PW as the y-axis. Your graph should include: 1. The PW when none of the factors are changed (y-intercept). 2. The sensitivity with respect to decision reversal should be noted for each factor (the x-intercepts). Include your supporting calculations. A nationwide hotel chain is considering locating a new hotel in Bigtown, USA. The cost of building a 150 -room hotel (excluding furnishings) is $10,000,000. The firm uses a 15 -year planning horizon to evaluate investments of this type. The furnishings for this hotel must be replaced every five years at an estimated cost of $3,250,000 (at time =0,5, and 10 ). The old furnishings have no market value. Annual operating and maintenance expenses for the hotel are estimated to be $400,000. The market value of the hotel after 15 years is estimated to be $3,000,000. Rooms at the hotel are projected to be rented at an average rate of $90 per night. On the average, the hotel will rent 60% of its rooms each night. Assume the hotel will be open 365 days per year. MARR is 15% per year. Graphically show the sensitivity of Present Worth to changes in the following factors: 1. periodic refurnishing cost, 2. annual expenses, and 3. occupancy rate (average percentage of rooms rented each night). On your graph, use percent change as the x-axis and PW as the y-axis. Your graph should include: 1. The PW when none of the factors are changed (y-intercept). 2. The sensitivity with respect to decision reversal should be noted for each factor (the x-intercepts). Include your supporting calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts